Bears are doubling down on Friday’s brutal session, states Ian Murphy of MurphyTrading.com.

Global equities have started the week firmly in the red with the Nikkei 225 (N225) in Japan closing down 3% overnight. European markets have taken up the baton and are off over 1.5% as I type. Monday the thirteenth is going to be one to remember.

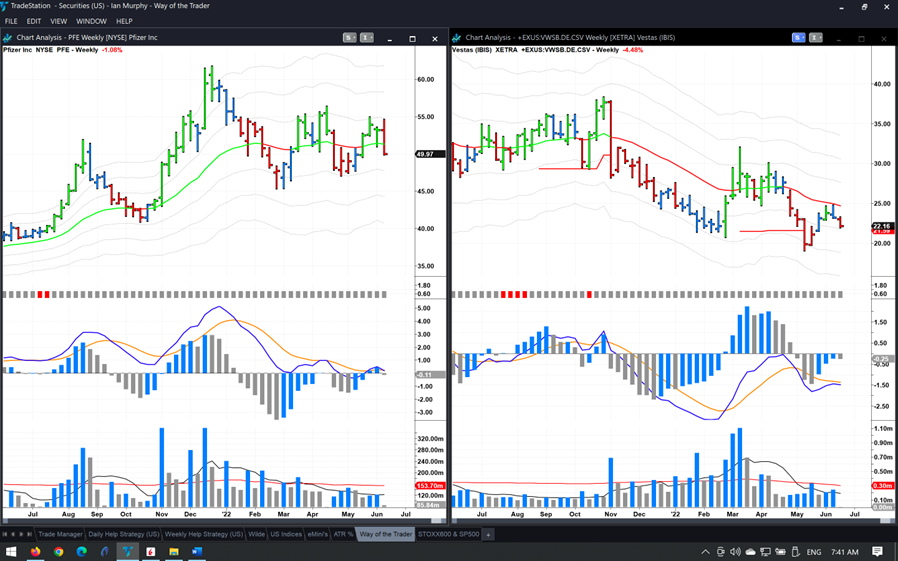

Click charts to enlarge

Micro E-Mini (MES=F) futures are down 2.2% (left above), and it looks as if US stocks are in for another difficult day.

Click charts to enlarge

The plan to build a WTF portfolio is quickly unraveling, and the emphasis now is on managing the loss in accordance with the strategic plan. As we are using a ‘weekly closing basis’ for protective stops, the week ahead will be challenging as we must sit through whatever comes and can only close a position if the price is about to close below the -1ATR line on Friday.

Of the two remaining open positions, the stop on Vestas Wind Systems A/S (VWSB.F) is currently at €21.77, and $47.79 on Pfizer (PFE). In pre-market trading, Pfizer is down about 1% but still above the stop level. Vestas is off almost 4.5% at 13:00 in Frankfurt and sitting right on the stop.

The obvious question here is why I don’t just close VWSB now and not wait for Friday? Because I know from extensive back testing and live experience that a trending stock can frequently pierce the -1ATR line intra-week only to recover as the week ends and rebound.

Learn more about Ian Murphy at MurphyTrading.com.