It’s official; we’re in a bear market, states Mike Larson, editor of Safe Money Report.

We crossed the proverbial “20% drop equals a bear market” Rubicon on Monday, when the S&P 500 (SPX) slumped almost 4%. That extended the average’s decline from the early-January peak to around 22%.

But let’s be honest. It has been a lot worse behind the scenes for a while now...and it’s absolute carnage in the technology sector. The tech-heavy Invesco QQQ Trust (QQQ) is down more than 27% year-to-date. In fact, it has now given up every penny of gains it had racked up in the last 19 months.

Or what about all those 100% garbage “D” and “E”-Rated tech stocks and SPACs I warned you to stay away from back when everyone on Wall Street still loved ‘em? They’re crashing and burning now, with Dot Com-bust-like losses.

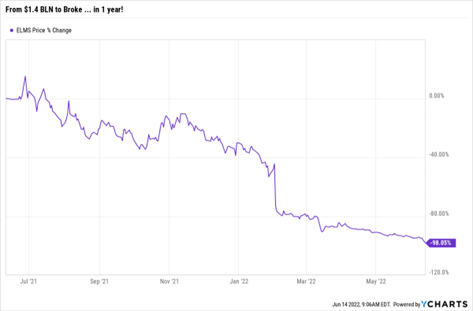

One of the worst of the lot, Electric Last Mile Solutions, Inc. (ELMS), actually just filed for Chapter seven bankruptcy this week. The pie-in-the-sky EV company went public only a year ago in a $1.4 billion SPAC merger...and now investors who bought into the hype have lost almost all their money.

Of course, you can’t spell “implosion” without the letters “I”, “P”, and “O”. And just as we expected and warned you about over the last 12 to 18 months, many of the junk IPOs Wall Street pumped out during the bubble are going bust.

Those of us who lived and invested through the Dot Com Bubble have seen this boom-and-bust pattern before. So, the red flags waving like mad were impossible to ignore.

Case in point: A whopping 311 companies IPO’d in 2021, raising $119 billion, according to Jay Ritter, a University of Florida professor who has tracked activity for decades. That was roughly double the 165 firms and $62 billion raised a year earlier.

But the percentage of IPOs with no current profits, past profits, or any expectation of future profits anytime soon also surged. Just like in the Dot Com Bubble.

Now IPO activity is collapsing, down 81% from a year earlier as measured by a different source, Dealogic. Plus, aftermarket performance has been atrocious. The Renaissance IPO ETF (IPO), which owns a representative basket of recent IPOs, plunged 53% in the last 12 months.

As for inflation, well, a recent Wall Street Journal editorial summed up the government’s and Federal Reserve’s failure on that front. The headline about Jay Powell’s “wishful thinking” read: “First it wasn’t real. Then it was ‘transitory.’ Now, we’re told the Fed will cure it with a few rate hikes.”

Translation: The Fed is still playing catch up!

Bottom line? There’s no telling how long this bear market will last, or how deep its losses will get. But I am certain that just sitting on your hands and trying to ignore it isn’t your best strategy as an investor. Follow the suggestions and advice I’ve been sharing all year for dealing with a tougher market environment.