There is probably a certain segment of the investing population that would look askance at me if I mentioned we’re seeing “strength in China,” states Sean McLaughlin of AllStarCharts.com.

They wouldn’t believe that is possible. According to the news media they consume, China is “a mess.” Perhaps that is true? But we only follow price here at our shop, and price is beginning to tell a different story.

Today’s trade idea comes from TWO seemingly unlikely places: China and Internet!

And when you see this chart of the KraneShares CSI Chinese Internet ETF (KWEB), you’ll see why:

The consolidation above that year-long downtrend line, combined with what may be an imminent breakout in relative strength has me interested in jumping in. And here’s some additional background from our head technical analyst Steve Strazza:

You won’t find many (if any) areas of the stock market that have outperformed energy stocks over the trailing three months, but Chinese Internet has done just this as KWEB has rallied roughly 50% since mid march. After enduring an 80% drawdown from last year’s highs, these stocks have carved out a constructive base and look ready to make a fresh leg up.

Chinese internet stocks are among the best-looking bounce candidates out there right now. We like them as a vehicle to play this relief rally. I like it. And best of all, we have a nearby risk management level that will help us minimize our risk. Additionally, we’ll further limit our risk by employing a bullish options spread where our risk is defined.

Here’s the Play:

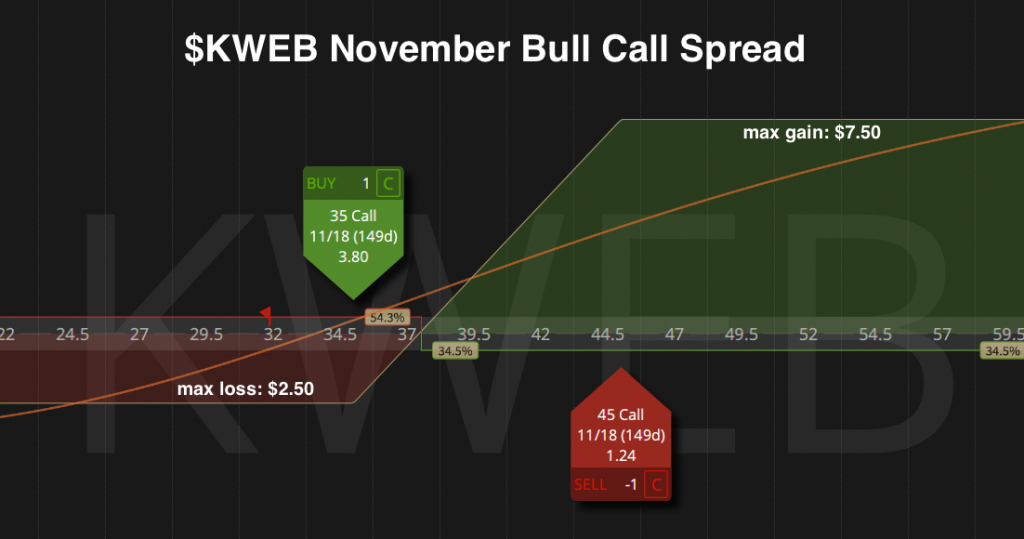

I like buying a $KWEB November 35/45 bull call spread for approximately $2.50 debit. This means I’ll be long the 35 calls and short an equal amount of 45 calls and the net debit I pay today represents the most I can possibly lose in this trade:

I prefer employing a spread here instead of just long calls because the implied volatility (which drives options prices) is relatively high. Feels to me a spread gives us better odds of success.

For risk-management purposes, I’ll be leaning against the $28 per share level to hold. If we see $KWEB close below $28, that’s my signal that we’re either wrong or too early. In either case, I’ll look to exit this position and salvage whatever is left of the premium.

If $KWEB follows through on its promise to the upside, I’ll look to close the spread for a profit when I can collect a $6.25 credit to do so. This would mean I’ve captured half of the maximum possible profit (our profit potential is capped by the short 45 calls), without having to hold the spread all the way into November’s options expiration. It would also be a 150% gain on my invested capital. Nice!

Learn more about Sean at AllStarCharts.com.