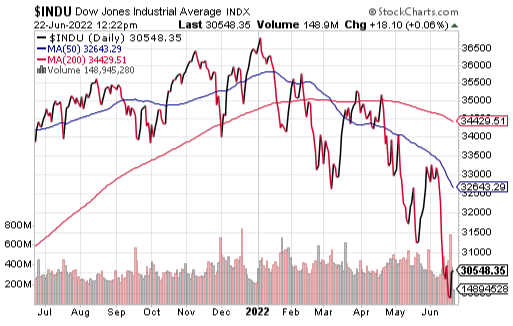

This morning I received an inquiry from a subscriber who asked me what I thought would be the market bottom on the Dow Jones Industrial Average (^DJI), explains Jim Woods, editor of Bullseye Stock Trader.

Here’s what I told him in response:

“A numerical value on a Dow bottom is nearly impossible to peg with any real certainty. That said, it would not surprise me to see the Dow fall much more from here. If we had another 10% pullback from the current value of 30,395, it would put the Dow at 27,355. And considering we’re down about 17% from the all-time high here on the Dow, another 10% down would be well within traditional bear market metrics.”

Yet what I also told him is that perhaps the more important question is when the market will bottom, and what events would cause a market bottom. Here I referred to my Three Keys to a Bottom, which are the brainchild of my “ secret market insider” that I partner with to bring you my daily market briefing, the Eagle Eye Opener.

Here’s the most-recent analysis on the Three Keys to a Bottom. Unfortunately, none of these factors has been triggered yet.

Last week, stocks fell to new 52-week lows (as measured by the major domestic indices). So naturally, the question here becomes, “When will this market form a bottom?”

Of course, nobody knows that answer definitively, but what we can say is that there are several key events that need to happen before we can expect to see any real bottom in stocks. Let’s take a quick look at each of these three keys to a market bottom.

1. Chinese Lockdowns Ease and Growth Recovers

Chinese authorities are hesitant to admit they’re wrong about the pernicious zero-Covid-19 policy, so we can’t expect them to publicly abandon it. Yet in recent weeks, the Chinese government relaxed lockdowns in Shanghai and Beijing. Unfortunately, they reimplemented some of the restrictions at the first sign of a few Covid-19 cases. If the Chinese can finally abandon this policy, markets can start to breathe more bullishly when considering global economic growth.

2. Inflation Peaks and Declines and the Fed Eases Off

Based on the latest Consumer Price Index (CPI) data, the idea that inflation has peaked has yet to come to fruition. However, CPI is a backward-looking indicator. If the Fed’s recent rate hikes can start to put a dent in inflation, that peak might not be too far away. If that happens, and if the Fed starts to be a bit less hawkish than it has been recently, and we saw some evidence of that at the June Federal Open Market Committee (FOMC) press conference, then stocks can begin to form a bottom.

3. Geopolitical Tensions Decline

Understanding what “improvement” will look like in the Ukraine war is very difficult, and at this point a ceasefire remains unlikely. The conflict now seems to be devolving into a stalemate that could last for months, quarters, or even years more. The war is a tremendous human tragedy, but from a market standpoint it’s the spike in commodities that’s causing headwinds on earnings and increasing the chances of a global recession. The bottom line here is this situation needs to improve before we can see a real bottom in stocks.

So, there you have it, my assessment of what it will take for stocks to make a material bottom, and for the overwhelming bias in the stock market to go from bearish to bullish (or at least back to neutral).