The Daily Help Strategy identifies a short-term bounce in US equity markets, and we can monetize the move in different ways depending on our risk profile and underlying market trend, writes Ian Murphy of MurphyTrading.com.

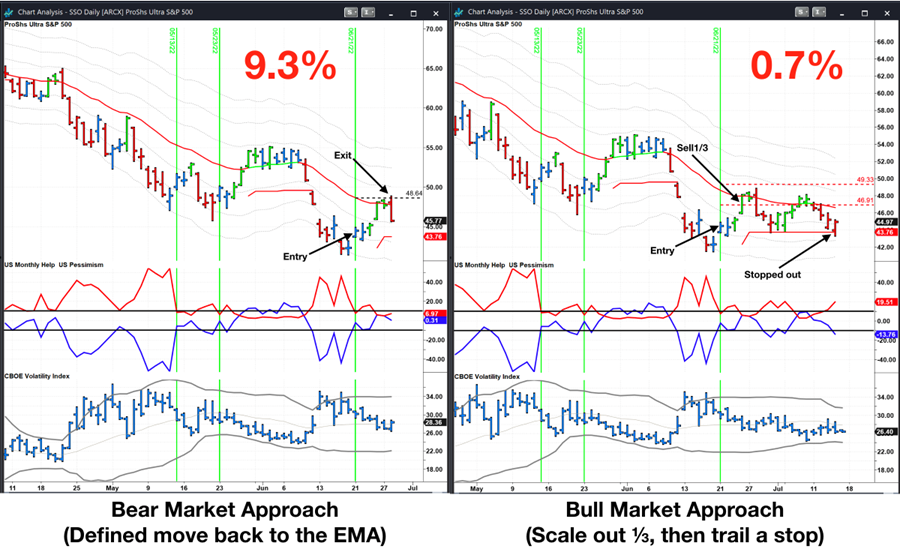

In bull markets, a bounce typically occurs after a brief pullback before the long-term upward trend continues, so an open-ended trade with a trailing stop is suitable. In bear markets such as we have now, a defined move with a price target is more appropriate as the move is likely to be short-lived.

In Tuesday’s presentation on the MoneyShow®, we looked at the two most recent triggers of the strategy and how they produced healthy profits when traded with a 'mean reversion' method by entering at the close on the day of the trigger and exiting the entire position when the price reaches the 21-period moving average line.

This is the bear market approach—in and out quickly with no trailing stop as shown on the left below.

Click the image to enlarge

The reason we avoid a trailing stop in bear markets is illustrated perfectly by the latest trigger on the ProShares 2x Geared ETF (SSO). A bear market ‘defined move’ approach produced 9.3% profit ($2,112) after five days on a $50k account risking 2%, whereas the bull market scale and trail’s approach netted only 0.7% ($159) and lasted 16 days, as shown on the right above.

Note how the trailing stop flatlined on June 27 and never moved an inch upwards after that because enthusiastic buyers never showed up to drive the price higher. Trailing stops only work when the underlying trend is bullish.

A recording of the presentation has been edited and uploaded to YouTube, click the screengrab above to view it.

Learn more about Ian Murphy at MurphyTrading.com.