The S&P 500 (SPX) shot out of the gate Friday morning on stronger-than-expected retail sales and a pair of positive earnings reports, says Jon Markman, editor of Strategic Advantage.

The combination sparked a rally that lifted the benchmark index to 3,863, a gain of 1.9%.

The big move higher was exactly what bulls needed to put a scare into bears. Between analysts cutting their ratings for stocks and tumbling consumer sentiment, the past two months have been good news challenges, to say the least.

However, retail sales in June rose 1.0%, slightly ahead of the consensus forecast. And better-than-expect financial results at Citigroup (C) and UnitedHealth Group (UNH) kept hopes alive that investment analysts have been too negative about second-quarter financial results.

We will see about that soon enough. The bulk of those reports is due over the next two weeks. This is still a bear market. Despite the explosive rally on Friday, the intermediate trend is definitely mired in a downward trajectory.

The bulls need Friday’s upside momentum to continue into the early part of next week. That will mean holding support at 3,750. There is overhead resistance at 3,940, the falling 50-day moving average.

SA TradeView: The ProShares UltraShort S&P 500 (SDS) closed at $48.22 Friday, a decline of 3.9%. It has been frustrating because the tape is not really trending.

Current: Long ProShares UltraShort S&P 500 (SDS) from $48.70. Target is $57.10; stop is $47.30 (after 11 am ET).

The Backstory: The Dow (DJI) climbed 2.2% to 31,288.26 on Friday and the Nasdaq (IXIC) was 1.8% higher at 11,452.42. For the week, however, the three major market indexes declined, with the Dow down by 0.2%, the S&P almost 1% lower, and the Nasdaq declining by 1.6%.

All sectors posted gains Friday, with financials the top gainer.

Breadth favored advancers seven-two and there were 30 new highs vs 208 new lows. The leaders were Eli Lilly and Company (LLY), Molson Coors Beverage (TAP), Murphy USA (MUSA), Option Care Health (OPCH), and Vonage (VG). Strange leadership cohort.

The dollar index dropped 0.5% to 108.03, declining from its highest level since 2002.

Atlanta Fed President Raphael Bostic on Friday suggested he would not support a much higher rate move, CNBC reported, while St. Louis Fed President James Bullard favors a 75 basis-point increase later this month, Bloomberg reported, citing a Nikkei interview on Wednesday.

The probability that the Fed will lift rates by 100 basis points fell to 31% from almost 45% on Thursday, according to the CME FedWatch Tool. The latest consumer price index turned out to be hotter than anticipated for June, bolstering the case for a stronger policy response from the central bank.

The University of Michigan consumer sentiment index rose to 51.1 this month from a record low of 50 in June. The long-run inflation expectations index fell to 2.8%. "We feel safe in maintaining our call for 75 (basis points) in July as well," Jefferies economists Thomas Simons and Aneta Markowska said. "Chatter about a 100 (basis-point) rate hike has ramped up since the release of the CPI report earlier this week, but we think expectations are dramatically more important than realized inflation at this point."

The US ten-year yield fell 3.3 basis points to 2.93%. West Texas Intermediate futures jumped 1.9% to $97.63 a barrel.

In company news, UnitedHealth Group's (UNH) insurance arm UnitedHealthcare said it will remove out-of-pocket costs in standard fully insured group plans for some preferred prescription drugs. Shares jumped 5.4%, leading the gainers on the Dow. Great company and solid stock.

Citigroup (C) rose about 13.3%, the top performer on the S&P 500 after second-quarter results surpassed Wall Street's estimates.

In other corporate earnings news, Wells Fargo (WFC) rose 6.2% despite lower revenue and earnings per share. JPMorgan Chase (JPM) shares were up 4.6% after reporting results on Thursday. Goldman Sachs (GS) and Bank of America (BAC), which increased over 4.4% and 7.1%, respectively, are expected to report second-quarter financials on Monday.

When stocks advance on bad news, very often the gig is up for bears. Pay attention.

Time to get a little more optimistic on inflation?

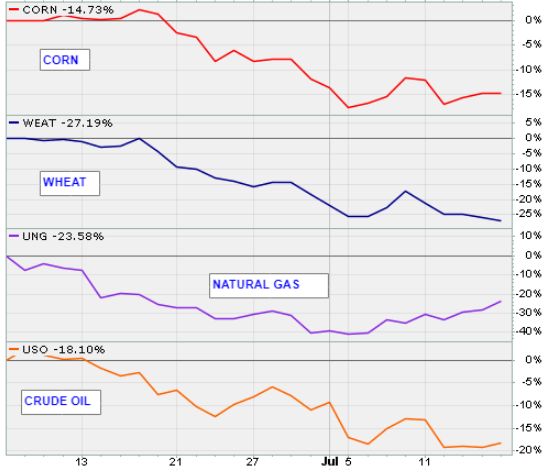

The Consumer Price Index came in much hotter than expected last week but commodities have fallen sharply in the past two weeks, as shown below.

Agricultural commodities (DBA) are down 20% from their peaks and energy and precious metals are down around 21%. The demand side appears to be drying up amid rising recession fears.

Excluding strategic reserves, crude oil inventories last week rose to the highest levels since the week of December tenth.

Bespoke Investment Group analysts note that while SPDR Energy (XLE) is still by far the best performing sector fund this year at +23%, it is 26% below its highs – which is a larger decline than the tech sector has experienced since it topped in late December.

Drilling a little deeper, ExxonMobil (XOM) is down 16.4% since June tenth but is still up 37% for the year, while EOG Resources (EOG) Is down 33% since June tenth and is still +8.65. But the star of the show is Occidental Petroleum (OXY), which is off just 9% since June tenth and is +100% year to date.…And with gasoline prices up sharply, no wonder refiner Valero Energy (VLO) is down 27% since June tenth but is still up 36.5%. This is still the market’s leadership group.

While US stocks are at least trying to carve out a surprise bottom connecting the June and July lows, European stocks aren’t even trying to fake a low. Check out the down-spiraling charts for the iShares UK (EWU), Italy (EWI), France (EWQ), and Germany (EWG).…Not to mention iShares Emerging Markets (EEM).…They all look like death. Full and real recovery will happen globally when it happens.

The one tech industry that is starting to look more interesting from a technical perspective is semiconductors, represented by the ETF VanEck Vectors Semiconductor (SMH). It looks on track to trace out an inverse head-and-shoulders bottom which, if validated, would potentially measure a rebound to the $250 area from the current $214 print. Key stocks to own if this move turns out to be real and not a false flag would be the bigs like Taiwan Semiconductor (TSM), Applied Materials (AMAT), Lattice Semi (LSCC), and Analog Devices (ADI). You know, the usual suspects.

More about this later in the week and month.