Netflix (NFLX) reported the loss of 970k subscribers in Q2 after the bell, writes Ian Murphy of MurphyTrading.com.

Click charts to enlarge

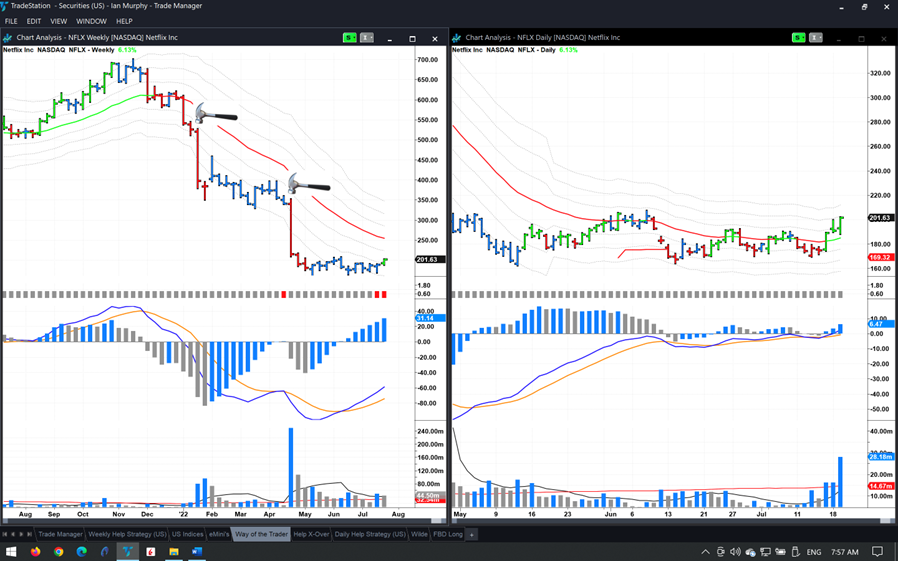

The previous two earnings reports were met with a whack-a-mole response by the market (weekly chart, left above) but the price is up 6% in pre-market trading as subscriber loss was not as bad as expected and upcoming revenue generators such as a crackdown on password sharing and the introduction of advertising are expected to offset lost subscriber revenue.

Netflix may be forming a base and in the process earned a place on the WTF Strategy watchlist—let’s see where the weekly bar closes. I would like to see it above the -1ATR line on a weekly chart at $223.52 before committing to a meaningful financial relationship with the stock.

Click charts to enlarge

On the Daily Help Strategy, S&P 500 Micro E-mini futures (ES=F) hit the target at 3958 overnight (black dashed line, left chart above) returning 2.4% on the trade. SSO didn’t get there yet falling short by just 8c in yesterday’s session.

An insightful question about the Risk Reward Ratio (RRR) on these bear market mean reversion trades came in last week. For example, in the futures trade, the reward was 2.4% but the risk at entry was 3.38%—obviously not the 3:1 ratio I recommend in the Five Limits of Risk.

The win rate on these mean reversion trades is so high we can take on additional risk if we have the appetite, but the skewed RRR is another warning signal highlighting the risk we are embracing. There is nothing wrong with making high-risk trades because that’s where the high profits are often found but we must also be able to live with the high losses which are part and parcel of high-risk strategies.

Learn more about Ian Murphy at MurphyTrading.com.