When we roll out a cash-secured put trade, we are spanning 2 contract cycles, says Alan Ellman of The Blue Collar Investor.

This article will detail how to enter and close our trades into our trading logs to best reflect the results over multiple time frames.

What is rolling out an ITM put strike?

This is where we buy back (buy-to-close or BTC) the short put as expiration approaches and immediately sell the same strike put option in the next contract cycle.

When to consider rolling out an ITM strike?

If a strike is in the money as expiration approaches, we may opt to roll the trade rather than close and exit the current option position. Reasons to take this approach include:

- There is no upcoming earnings report in the next contract cycle

- The underlying security still meets our system requirements (fundamental, technical, and common-sense screens)

- The rolling calculations do meet our stated initial time-value return goal range

The difference between rolling and existing an ITM put strike as expiration approaches

When we roll the option, we BTC (buy-to-close) the near-term strike and STO (sell-to-open) the next contract same put strike. If we decide to close the ITM strike and simply exit the trade, we only close the current put trade and look to establish a new cash-secured put trade (usually) with different security at the start of the next contract cycle. Let’s use a real-life example with NVIDIA Corporation (NVDA) to demonstrate a rolling example.

How to enter our rolling trades into our trading log

Our current contract month trade is completed as initially structured. The initial time-value return is the same as the final time-value return. The current value of the underlying security is entered into our spreadsheet (trading log) as the only adjustment entry.

The rolling-out trade is then continued in the next contract cycle where the current market value (ending value at the expiration of the expiring contract) is entered, and the net option credit is also entered with the next expiration date. The net option credit consists of the new premium less the cost-to-close debit from the previous contract. This is shown in the upcoming screenshots.

Real-life example with NVIDIA Corp. (Nasdaq: NVDA)

- 8/20/2021: NVDA trading at $208.16

- 8/20/2021: STO the 9/24/2021 $200.00 put at $5.65

- On expiration Friday, 9/24/2021, NVDA is trading at $199.00, leaving the original short put strike ($200.00) in the money.

- BTC cost is $1.10

- STO the next month $200.00 put is trading at $5.00

- A decision is made to roll rather than close the trade

Initial trade return on option (ROO)

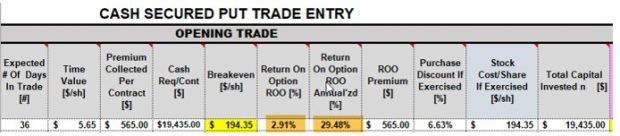

NVDA: Initial Trade Structuring

The Trade Management Calculator shows an initial return on the option of 2.91%, 29.48% annualized based on a 36-day trade. If exercise is allowed, shares would be purchased at a 6.63% discount from the price of NVDA when the put sales were initiated.

How is rolling out the ITM strike managed with our BCI Trade Management Calculator?

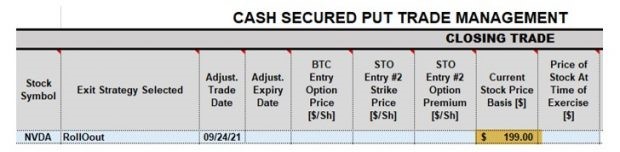

The original put trade is considered closed by entering only the current price of the stock on expiration Friday ($199.00).

NVDA: Closing 1st Month Trade Before Rolling

Final calculations prior to rolling the ITM strike

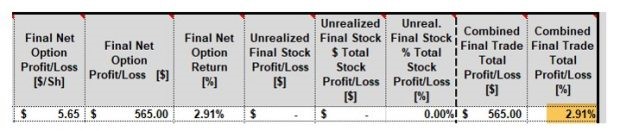

NVDA: Final Current Month Calculations Before Rolling

The spreadsheet will reflect the final time-value return to be the same as the initial time-value return (2.91%) as well as the same total net income of $565.00 for the one contract.

Entering the rolled-out trade in the next contract cycle

We enter the following stats into the next contract cycle:

- Stock price: $199.00

- Strike price: $200.00

- Net premium: $3.90 ($5.00 – $1.10)

The spreadsheet will reflect the following initial calculations:

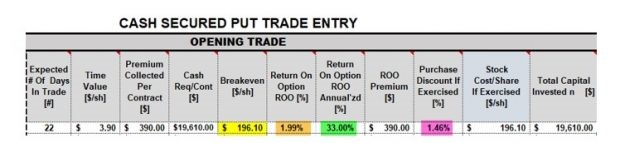

NVDA: Rolled-Out Trade Entry

The calculator shows the following stats:

- A 22-day return of 1.99% (brown cell).

- An annualized return of 33.00% (green cell).

- A breakeven price point of $196.10 (yellow cell).

- A purchase discount of 1.46%, if exercised (pink cell).

Discussion

We consider rolling an ITM put strike when the security still meets all system criteria, and the calculations align with our stated initial time-value return goal range. The initial trade is closed reflecting the initial time-value return and the current security price and net option credit is entered into the next contract cycle.

Learn more about Alan Ellman on the Blue Collar Investor Website.