Earnings reach a crescendo this week with influential big names such as Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN) set to announce, writes Ian Murphy of MurphyTrading.com.

Considering these three tickers makeup over 16% of the weight of the S&P 500 index (SPX), their forward guidance will either crush or support the recent short-term bounce in equity prices.

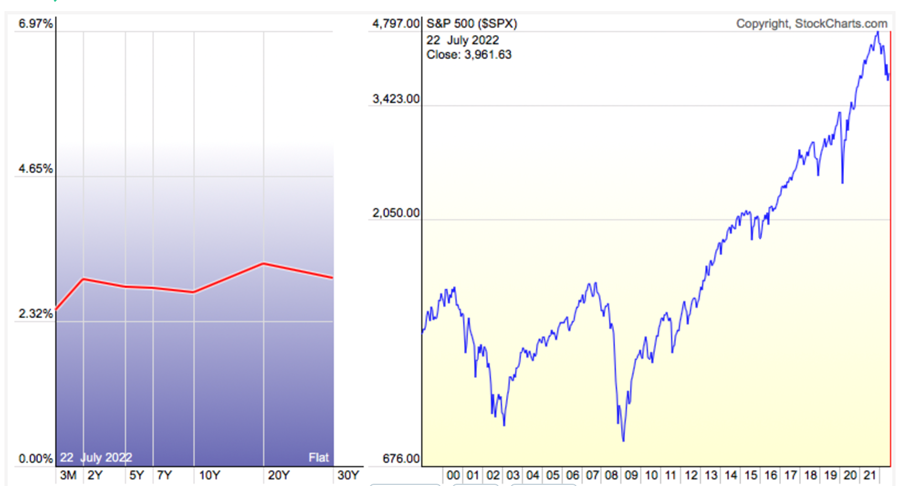

As if that wasn’t enough, the Federal Reserve Open Market Committee meets today and Wednesday and will finish up with an interest rate announcement which is expected to be an increase of 0.75%, but a full 1% is not being ruled out by the market. This could create a rare event known as an ‘inverted yield curve’.

Click the image to enlarge. Source: stockcharts.com

An inverted curve occurs when the interest rate paid on a three-month loan to the US government is higher than a 30-year IOU. This illogical situation occurs when money flows out of equities and other assets into fixed income, and an inverted curve has flagged recessions in the past with a pronounced example before the 2008 crash.

Depending on how things go on Wednesday afternoon, the current curve may invert.

However, the equity market usually doesn’t just tank on the day of the inversion; the curve was inverted for months before the 2008 selloff began. Also, the equity market has already pulled back into bearish territory, and the Covid-19 measures with their rock bottom interest rates for an extended period make the current yield curve a little different. Nevertheless, it’s another warning signal starting to flash.

Learn more about Ian Murphy at MurphyTrading.com.