There is not a lot to add to Friday’s note other than to say the three trades being monitored are doing well and all in profit, writes Ian Murphy of MurphyTrading.com.

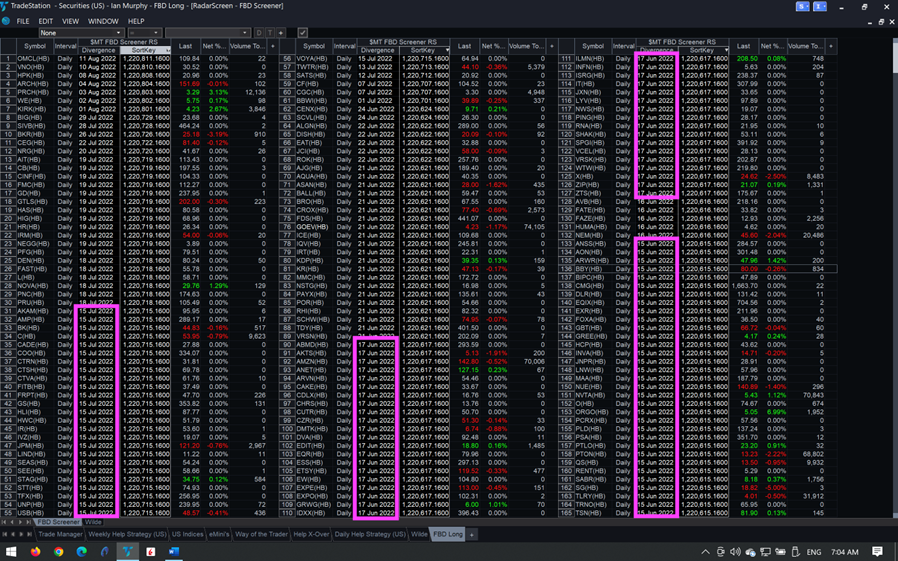

Queries have come in about how I sourced the Arch Resources, Inc. (ARCH) and ProPetro Holding Corp. (PUMP) trades. I am using RadarScreen on TradeStation to get trading ideas for the FBD strategy, but any screening application can be used for your favorite strategy.

In the screener, I currently have a watchlist of 2600 US stocks which are an amalgamation of the constituents of the Russell 2000 index and S&P 500 (SPX). To that, I added stocks with a short float >10% to catch short squeezes which are ideal for the FBD strategy.

From the list, I removed anything trading below $3 and tickers with an average daily volume of less than 300k per day. This last part was to remove stocks with low liquidity which might have been in the 10% short float scan or the Russell list.

Click the image to enlarge

After that, I just sit back and let the screener cycle through the 2600 stocks every 30 seconds of the day looking for setups as they occur in real-time. Something to note when using a screener—we can go for days without getting a single good trigger and it can be challenging to sit around as we are tempted to take second-rate setups. Then something changes in the market, and we get a cluster of triggers all at once (look at July 15, June 17, and Jun 15 above)—it’s as if we go from a famine to a feast. Then the challenge becomes which of the triggers to take.

This happens because the market goes through cycles and a certain part of the cycle is the most conducive for the strategy we are using, the trick is to wait for the market cycle to come to us rather than chasing it.

Learn more about Ian Murphy at MurphyTrading.com.