Well, that was quite the performance by the stock market last week, notes Bob Lang of ExplosiveOptions.net.

The S&P 500 (SPX) is now up 2.65% for the month of August, but what makes that most impressive is the index has only been up three times in ten sessions. This means market action has been driven by only three sessions; the S&P 500 was red for seven of those ten sessions. This is not normal activity, and now the bulls are worked up in a frenzy, wondering if markets are about to cross into bull territory.

After reaching deeply oversold levels only two months ago, it seems the bulls have regained control of the market. These last few weeks have shown some impressive technical characteristics: low put/call ratios, strong breadth, strong volume, positive money flows, shifting sentiment, and price breakouts. This technical combination had been missing from prior moves up in May and March.

So, is this it? Is the bear dead? And more importantly:

Are we headed into bull territory?

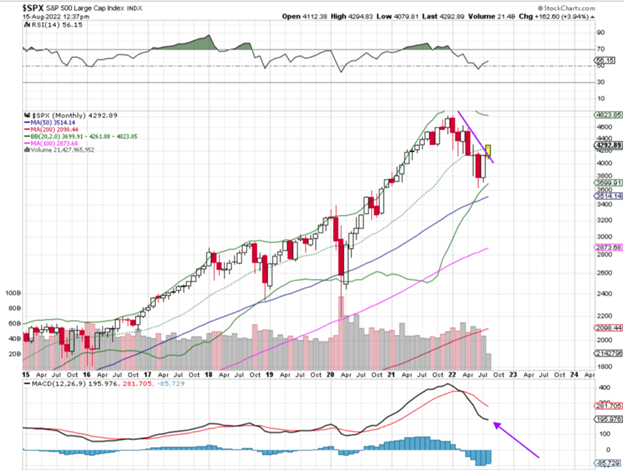

We may have an answer sooner rather than later. The big downtrend line that appeared at the start of 2022 has held on a couple of occasions in 2022. It’s about to be tested again. Price action has come in fast and furious, and it may be enough to reverse that downtrend.

Keep your eye on the MACD. If you see a crossover and then confirmation, we can consider the market moderately bullish. This should happen (or not) within a few short days.

In the chart below, the purple arrow shows the MACD. It’s not close to crossover yet, but the downtrend line above has been crossed, so the MACD will start to move over the next couple of months (November at the earliest).

Most of us are tired of this bear market and want it to be over. Don’t start trading like a bull just yet, though. Rushing things is a recipe for disaster. Wait for confirmation and resist FOMO. Once a bull market has been confirmed, you can switch into bull trading mode. As I keep saying, continue to play it cautiously until you get an all-clear.

Learn more about Bob Lang at ExplosiveOptions.net.