Market watchers are on edge as they await this week’s festival of economics at the Jackson Lake Lodge in Wyoming, writes Ian Murphy of MurphyTrading.com.

The headline act (Fed chairman Powell) is due to perform at 10:00 EDT on Friday, and his words will be closely monitored for any hints on the future pace of interest rate increases.

In the meantime, it pays to watch the big money, and right now hedge funds are playing the short game. Analysis by BNP Paribas on hedge fund holdings reveals a record level of net short positions on S&P 500 (SPX) futures, while over at Goldman Sachs (GS), three of their hedge fund clients are short US equities for each one who is long.

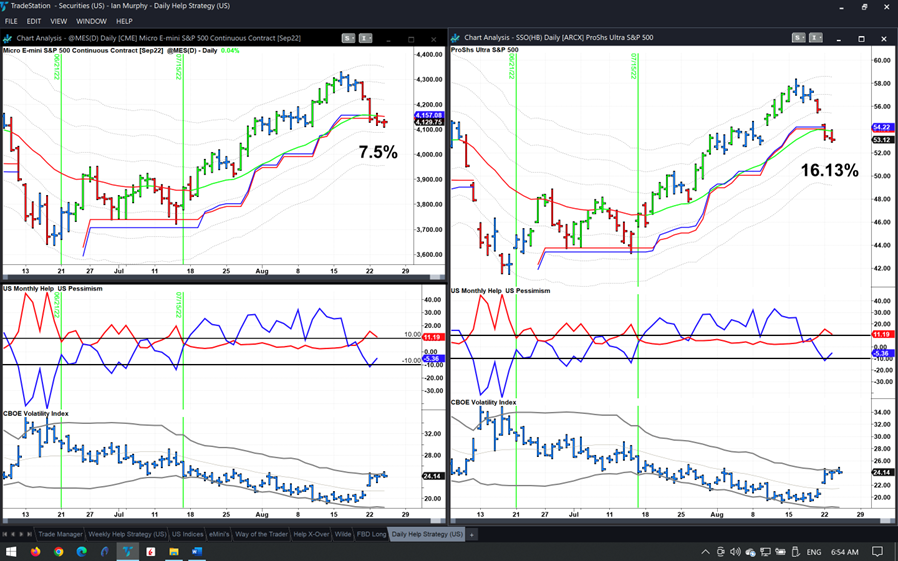

Click chart to enlarge

In terms of trading, trigger #141 on the Daily Help Strategy was stopped out on Monday for a profit of 16.13% on ProShares Ultra S&P500 2x Shares (SSO), whereas Micro E-mini futures gained 7.5% since the entry on July 15.

Bear in mind the SSO ETF moves twice as much because of the two-times gearing, which is great on the way up but dangerous on the way down. A well-positioned trailing stop is essential because pullbacks on this ETF can be brutal. Also, opening gaps over the trailing stop are not unheard of with SSO, but thankfully this exit passed off without a hitch.

For this reason, some traders prefer to take these triggers with futures (top left on the chart) and use the margin on their account for the gearing. The results are similar, but you avoid the opening gaps on the ETF because futures trade overnight on weekdays.

Learn more about Ian Murphy at MurphyTrading.com.