Powell’s speech on Friday didn’t disappoint, writes Ian Murphy of MurphyTrading.com.

He got straight to the topic (interest rates), said his bit, and walked away. It was fascinating how he referred to people’s behavior in the 1970s when inflation was running hot, and how households and businesses fixated on rising prices and started to factor inflation into their budget planning.

The Fed is beginning to see the same behavior returning because we are all talking about inflation, and they are determined to prevent discussions on the subject from becoming the norm. So, interest rate increases are now as much about changing the conversation as they are about making borrowed money more expensive. The whole thing lasted just about eight minutes and can be seen here.

Click charts to enlarge

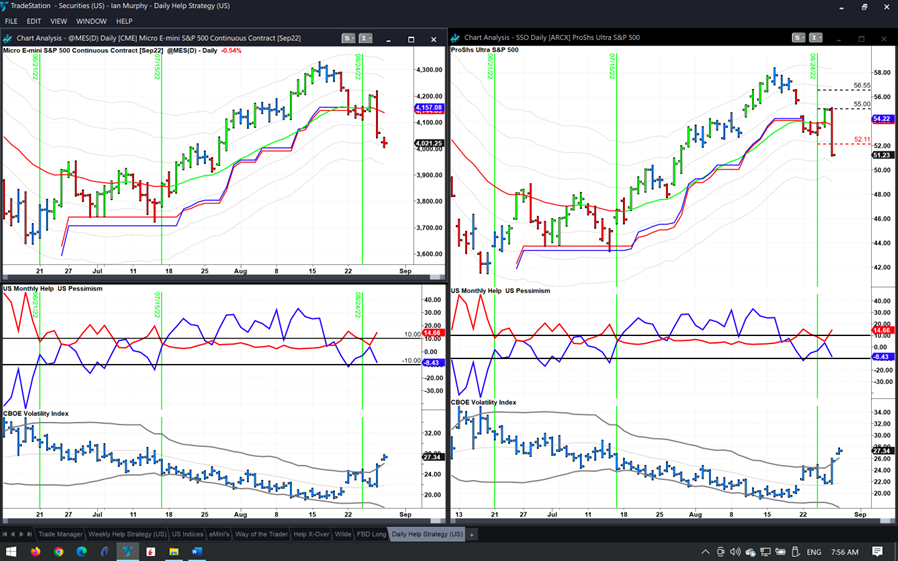

Not surprisingly, the S&P 500 (SPX) tanked on the news (left on charts above) and continues to trade down with about an hour and a half to go before the regular US stock market session opens.

Click charts to enlarge

The Daily Help Strategy was stopped out, but not before rising to hit the first target on ProShares Ultra S&P500 2x Shares (SSO) (right above) and this brought open positions close to breakeven. Some clients also emailed to say they moved up their protective stop to the entry price in the 30-minute window before the speech, and this resulted in an acceptable profit on the trade. Well done!

Learn more about Ian Murphy at MurphyTrading.com.