Global equity markets suffered their worst drop in two years yesterday after consumer price data in the US came in stronger than expected, writes Ian Murphy of MurphyTrading.com.

Click images to enlarge

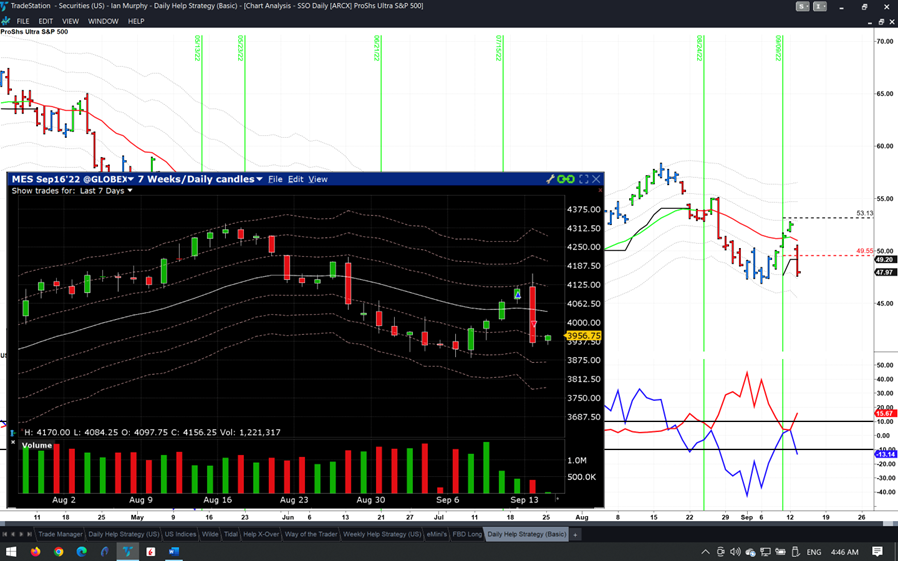

As soon as the CPI data was released at 08:30 ET (red bars above) markets sold off based on the expectation that the Federal Reserve is now more likely to raise rates aggressively at their next meeting on September 22, with a full 100-point hike possibly on the cards.

Click images to enlarge

At yesterday’s close, three-month US treasuries were paying 3.28%, while a 30-year IOU to Uncle Sam will only pay 3.51% (red line above). This means we are close to a yield curve inversion which has a great track record in flagging a selloff in stocks accompanied by a recession.

Click images to enlarge

In other good news, the latest trigger on the Help Strategy was stopped during yesterday’s plunge and failed to reach the first target on ProShares Ultra S&P500 2x Shares (SSO) or futures (in which I had a position, as shown above). So, it’s back to cash as we sit and wait for the market to make its next move.

Learn more about Ian Murphy at MurphyTrading.com.