The performance of utility stocks in a bear market offers an insight into the underlying sentiment of participants, writes Ian Murphy of MurphyTrading.com.

If utilities hold up while the rest of the market sells off, then investors are still broadly optimistic on equities but are being selective in current conditions. But if utilities are selling off also then investors are running for the exit and dumping everything.

Looking at US economic sectors on weekly charts, every ETF is currently bearish except utilities (orange circle). Utilities tanked in April, May and June along with the overall equity market, but the sector is holding up somewhat in the current bearish trend. I will be watching this ETF closely in the coming weeks to see how it holds up.

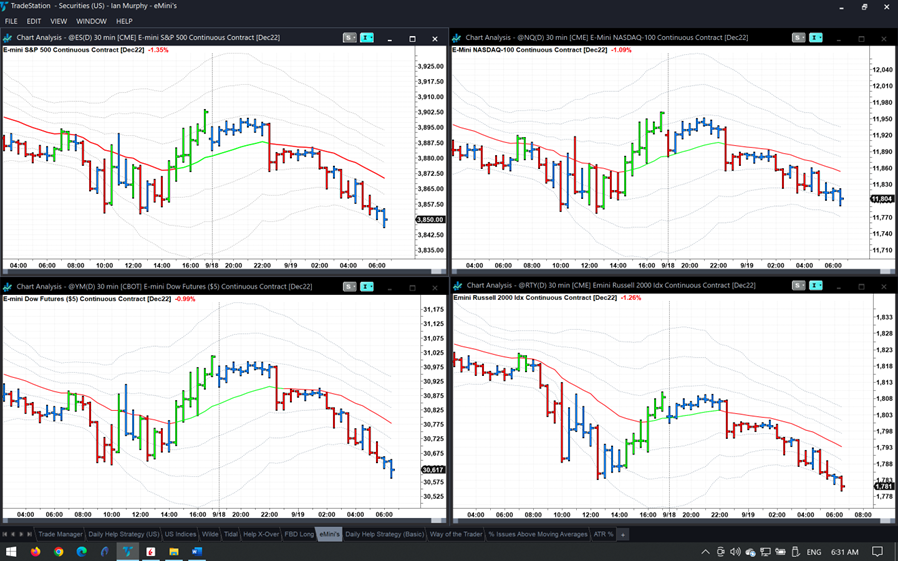

The week ahead will be dominated by Wednesday’s Fed meeting and interest rate decision with a hike of at least 0.75% expected. Futures are currently trading below Friday’s close, signaling what may be the beginning of another bearish week for stocks. But let’s not forget those are also the conditions for a Help strategy trigger.

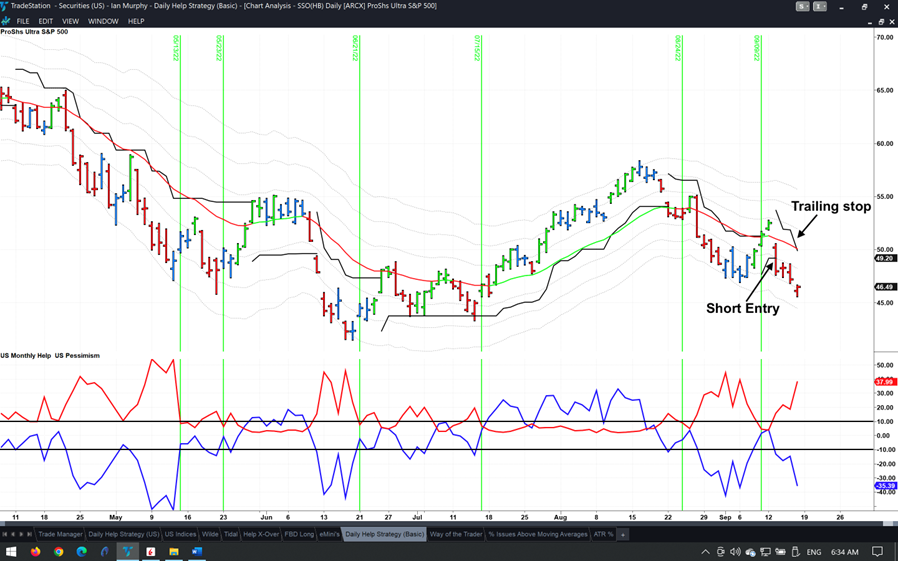

Speaking of which, for those of you using the “order reversal” method for exits on the Help Strategy (you turn a long position into a short one when the stop is hit rather than going to cash), the trailing stop for the current live short position is shown above in black, and it finished at $49.89 on Friday. Assuming an entry at the long trailing stop, the position is up 5.5% based on Friday’s close.

Learn more about Ian Murphy at MurphyTrading.com.