Have you ever noticed that childhood memories come about in all sorts of seemingly unconnected ways, states Jim Woods of The Deep Woods.

Perhaps it’s just the way human memory functions, which is more like an association machine than a tape recorder. But when I see or hear words and/or concepts that evoke strong remembrances of things past, my mind is shuttled directly into a Proustian recollection.

I had one of those recollections today that was prompted by the Federal Reserve, and it was, of all things, about gumdrops.

In my youth, I liked a candy called “DOTS,” which I discovered was the number-one-selling gumdrop brand during my research for this article. As the Tootsie website states, DOTS are "a snacking staple for both moviegoers and candy enthusiasts everywhere…Tootsie produces more than four billion DOTS annually from its Chicago plant…”

Well, I haven’t eaten DOTS in a long time, but I have been digesting them for many years now, and today I was served up a hawkish-tasting and bitter dose of the dots courtesy of the Federal Open Market Committee (FOMC).

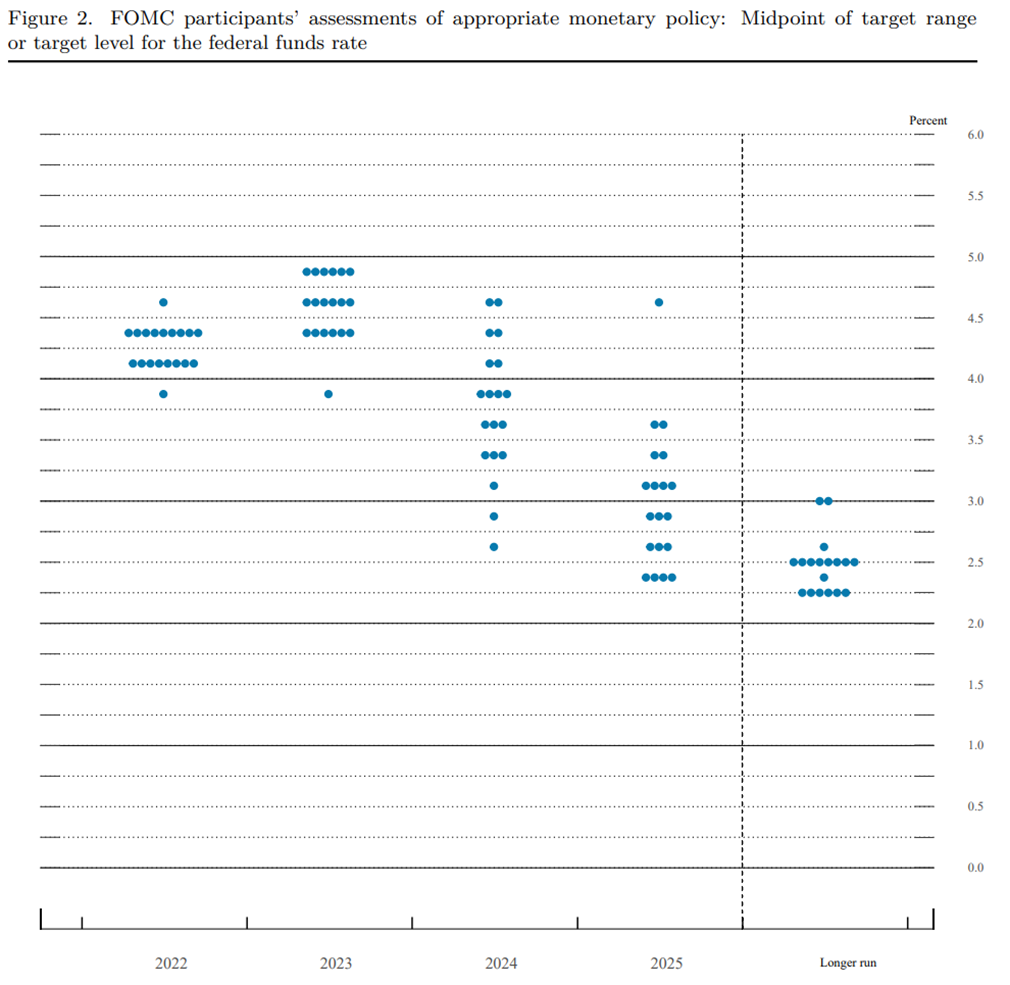

The term “dots” is Wall Street shorthand for the “dot plot,” and this is a chart that plots out where each Federal Reserve member thinks the federal funds rate will be at the end of a specific period. The graphic here from today’s FOMC data release shows where Fed members expect rates will be at the end of each of the next several years.

Here, the dots show that the medium projection for the federal funds rate at the end of this year is to be at least by another 125 basis points to a range between 4.25% and 4.5%. So, after yesterday’s announced a 75-basis-point hike in the federal funds rate to between 3% and 3.5%, and considering the Fed has two more meetings this year (November and December), that means that there will likely be another 75-basis-point hike at the November FOMC meeting and a 50-basis-point hike at the December meeting.

Those numbers are why I say the Fed has served the markets a hawkish dish of dots because before yesterday’s FOMC meeting announcement, the market was only pricing in a 50-basis-point hike at the November meeting and a 25-basis-point hike at the December meeting.

Perhaps more importantly, the FOMC now has projected that the so-called “terminal rate,” or the level at which rate hikes would stop, at a range between 4.5% and 4.75%. Interestingly, after the June FOMC meeting, the median projection for the terminal rate was around 3.75%.

The reason this terminal rate matters is that, at this point, investors just want to know when rate hikes are going to stop. Over the past two weeks, the main reason stocks have declined is because the market priced at a higher terminal rate than was previously expected, from 3.875% - 4.125% to 4.25% - 4.50%. Today’s even higher terminal rate now increases the chances the Fed will engineer an economic “hard landing” rather than a “soft landing,” and that, in turn, has weighed on stocks.

As for the market reaction to yesterday’s FOMC news, we initially saw stocks sell off right at the 2:00 pm ET announcement. Yet when Federal Reserve Chairman Jerome Powell took to the podium for his press conference, the markets mounted a rally that sent the major indices into positive territory.

So, now the equity market is at yet another inflection point, as smart money continues to price in the highest cost of money in more than 14 years. Will that new pricing means more bitter-tasting bearish trading ahead?

While no one can say for sure, today’s hawkish taste of the Fed dots certainly doesn’t offer us a very sweet box of bullish gumdrops.

Learn more about Jim Woods here.