Stronger-than-expected employment numbers in the US on Friday were not welcomed by equity markets, writes Ian Murphy of MurphyTrading.com.

In an environment where anyone who wants a job can get one, the Fed has no reason to ease up on interest rate hikes—it’s a case of good news for jobs is bad news for stocks.

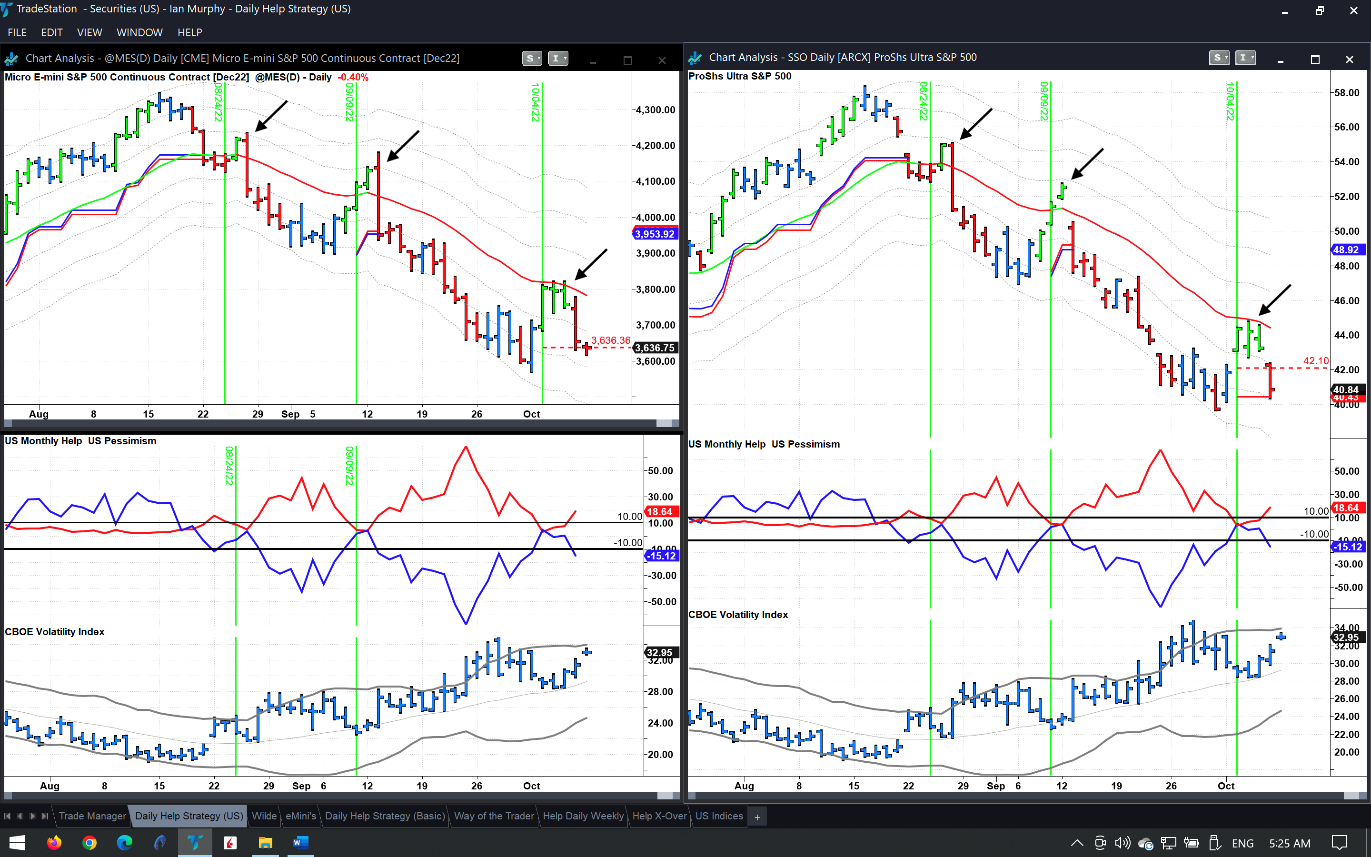

From a technical perspective, the reason the S&P 500 (SPX) sold off on Friday is almost irrelevant because it failed yet again to close above the 1ATR line on a daily chart and only made it to the 21EMAC on this occasion (arrows below). Do you remember why it was reversed on previous occasions? Does it matter? Friday’s action has returned the index to its bearish trend, period.

As for trading, you will recall the Weekly Trend Following portfolio continues to sit in cash while I take daily swing trades when they arise using the Help and FBD strategies. The initial protective stop on the latest Help trigger was stopped out on ProShares Ultra S&P500 2x Shares (SSO) and Micro E-mini futures on Friday (red dashed lines), as these trades must be closed out quickly if they are not performing. Thankfully both triggers were stopped out at the correct price on Friday and no slippage occurred.

In the week ahead there will be plenty to occupy the minds of market watchers with US Producer Price Index (PPI) data before the opening today, and the minutes from the last Fed meeting after lunch. Thursday and Friday bring the Consumer Price Index (CPI) and Core Retail Sales numbers, both of which will offer insight on inflation in the US.

Learn more about Ian Murphy at MurphyTrading.com.