Vertical spreads are the basic building blocks of many option spread strategies, explains JC Parets of AllStarCharts.com.

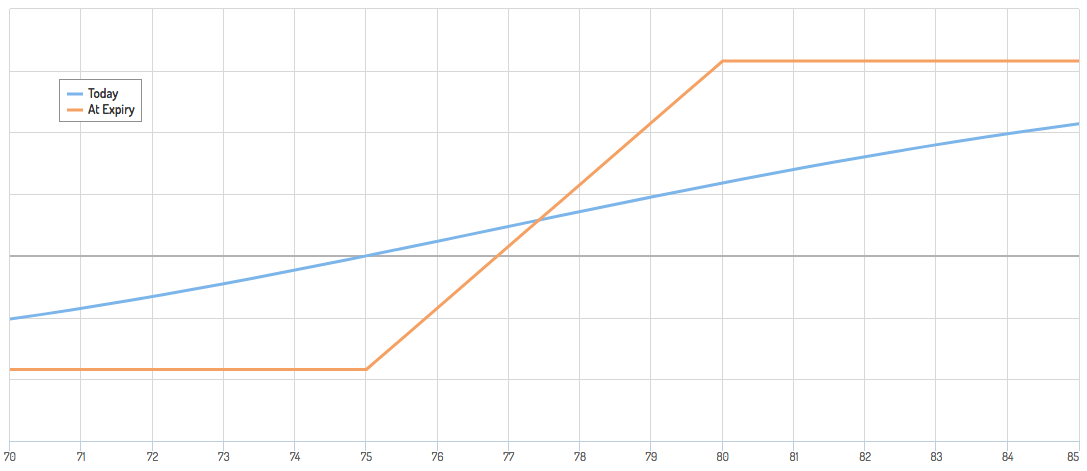

And they might be the most versatile, comprised of both a long option and an offsetting short option in the same class (put or call) and the same expiration. The risk in these trades is defined and limited to the price paid for the spread (debit spreads) or the margin required to hold the trade minus the credit received at trade initiation (credit spreads).

Bullish participants could get long a call and offset it with a further out-of-the-money short call for a smaller net debit than just a straight long call purchase. This is called a Bull Call Spread. Of course, there is no free lunch and in exchange for a lower net debit to participate, you’ll be giving up any potential gains above the short call strike. As with any debit spread, your risk is limited to the price you paid to enter the trade.

More cautiously Bullish participants can also consider using put options. In this case, you would sell short a put nearish to current prices, and then you would purchase a further out-of-the-money put. This Bull Put Spread would result in a net credit. In this case, all you’re really pulling for is underlying to not trade too far down. Any other result (slightly down, flat, up) will result in you keeping some or all of the premium you initially collected when you go to close the trade.

Conversely, if you’re bearish, you’d either execute a Bear Put Spread which is long a put and short a further out-of-the-money put for a net debit, or a Bear Call Spread which is short a call and long a further out-of-the-money call for a net credit. Just like with the bullish spreads above, the debit spread is a more aggressive choice while the credit spread is the more conservative route.

Defined Risk and Limited Upside are Key Characteristics of Vertical Spreads.

In Practice

Generally*, options premiums (in terms of volatility) are more expensive at lower prices. This is normally due to the fact that market participants are more fearful of the downside and like to purchase puts to protect themselves. This being the case, I usually like to use vertical spreads in such a way that I could put this volatility skew slightly in my favor.

For example, when I’m bearish on a stock or an ETF, I find that it’s generally advantageous to purchase a Bear Put Spread. In this situation, I’ll be purchasing a put and selling short a lower strike put which has a higher implied volatility than the put I purchased. Buy low sell high. And likewise, if I’m more cautiously bearish, I could sell a Bear Call Spread where I’m short a near-the-money call and long a further out-of-the-money call. The short call will have the richest premium (in terms of volatility) in the position, while the long call will be the cheapest.

When I’m bullish, I generally will not use vertical spreads because in these situations I’d be buying the more “expensive” volatility strike and selling the “cheaper” strike. In bullish situations, I prefer to use naked long calls, naked short puts, calendar spreads, or risk reversal spreads.

*This definitely isn’t always the case. Sometimes a pending news item, a stock in a runaway upside breakout, or a stock that is heavily shorted, might have participants spooked about the upside risk (especially if they are holding large short positions). In cases like this, I’ve definitely seen situations where the premium on upside options is more expensive than those below.Learn more about JC Parets at AllStarCharts.com.