Bears got everything they wanted Friday, and the S&P 500 still soared 2.5% to 3,901, states Jon Markman, editor of Strategic Advantage.

The big gain helped the benchmark index jump nearly 4% for the week, the second consecutive big week-long rally. Stocks should have been crushed by these news items Friday: personal consumption expenditures data showing inflation remains stubbornly high; the yield for the Ten-Year Treasury bond moved back above 4%; and disappointing Q3 earnings from tech giants Amazon.com (AMZN), Microsoft (MSFT) and Meta (META).

And yet bears were not able to capitalize. The futures overnight Thursday were deep in the red but quickly turned positive in the regular session and never looked back.

Usually when bad news results in a positive market reaction, it means the fix is in. It's counterintuitive but occurs when big market participants have anticipated these negative developments and now expect a reversal...while independent investors are looking for recent negative momentum to continue. When they are right, this is how the big money gets bigger.

Of course, they are not necessarily right. We’ll soon see who nailed this test, but I would note that the big guys usually got big for a reason. “Buy the rumor, sell the news” is a market cliche that has a lot of validity.

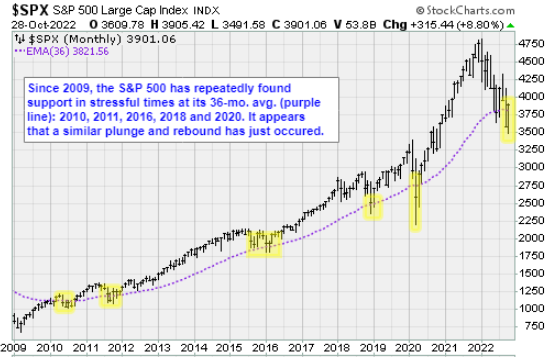

The stronger close means the declining 50-day moving average for the S&P 500 (SPX) at 3,840 is now key support. I would be shocked if the index does not retreat to that level early in the coming week for a test of bulls' will and composure.

The next important resistance point is now 4,084, the gap from September 12.

Strategic Trade: Current position is WisdomTree Bloomberg Floating Rate Treasury ETF (USFR), a cash alternative. Keep holding.