I recently correctly predicted “The tightening of the Fed and the inventory correction will force commodities and Bitcoin prices to continue to decline,” states George Dagnino of Peter Dag Strategic Money Management.

Let us see if monetary and economic conditions have changed enough to alter the downtrend of Bitcoin.

The business cycle is in Phase Four. This is the most treacherous phase for the economy, the financial markets, and investors.

This is the time when all the excesses created in Phase One and Phase Two are corrected. In 2022, for instance, the generous stimulus programs and the Fed’s aggressive injection of liquidity were followed by record-breaking growth of the economy.

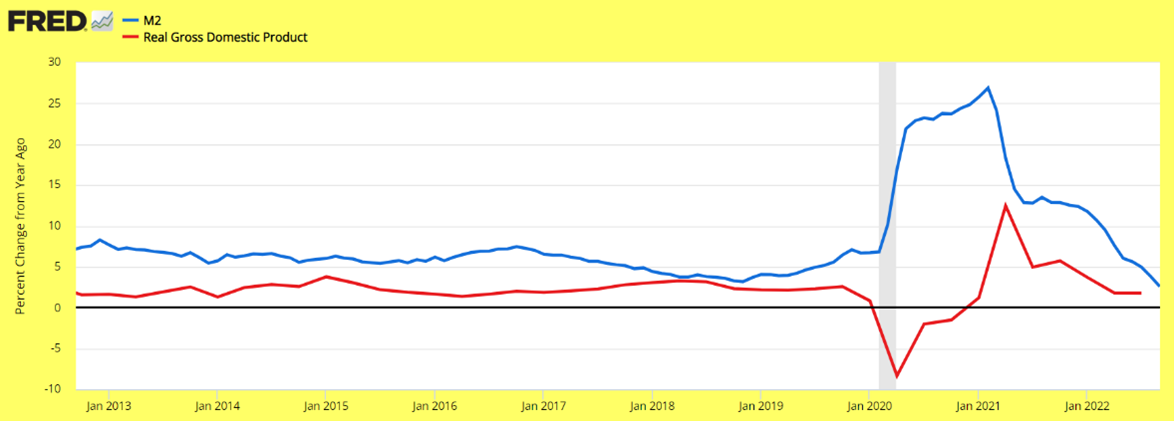

The money supply M2 soared 26.9% y/y and real GDP responded with a lag of several months with an unsustainable growth of 12.5% y/y (see above chart).

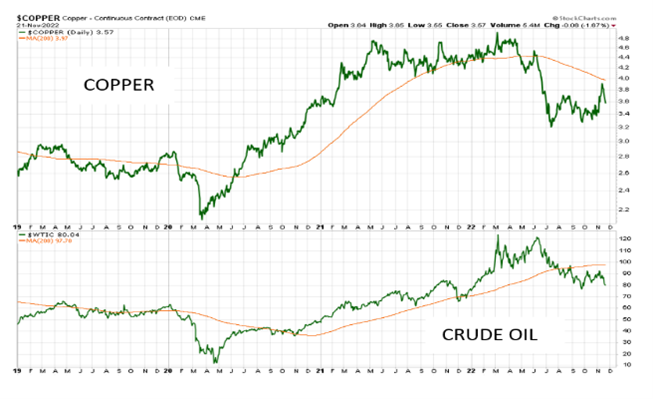

Commodities responded promptly to the strengthening economy.

Copper and crude oil soared in response to the extreme demand caused by government and Fed stimulus programs (see above chart).

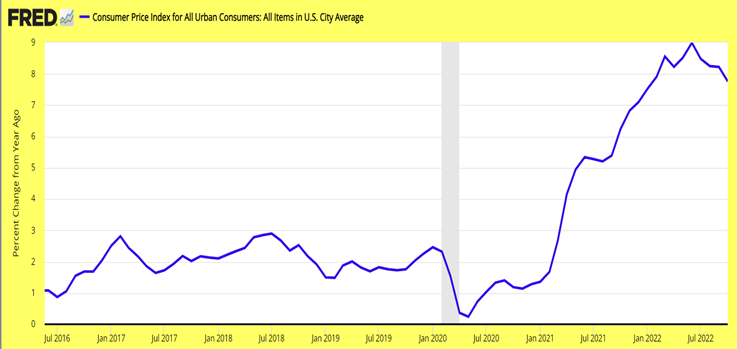

Inflation quickly rose because of the stronger economy and sharply higher commodities (see above chart).

As inflation started to impact real income, consumers’ sentiments collapsed. This was the signal the business cycle entered Phase Three. This trend was further reinforced by a sharp slowdown in M2 (see the first chart) and the flattening of the yield curve (10s/2s).

Businesses, however, continued to increase production responding to the sharp increase in demand following the lockdown. Inventories were accumulated at a double-digit pace when real inventory growth has historically been expanding in the 3%-6% range.

Production is now slowing down as companies need to reduce the huge inventory levels. The business cycle is now in Phase Four. As mentioned above, this is the phase when all the excesses must be brought under control to reestablish consumers’ purchasing power.

Inventories must be liquidated. This is achieved by reducing production and lowering prices. Raw material purchases are reduced, placing pressure on commodities. Borrowing is curtailed as programs to improve or increase capacity are delayed with the immediate effect of facilitating lower interest rates.

Phase One will begin when M2 starts rising again, the yield curve steepens, and interest rates and inflation decline in a major way, enough to lift consumers’ optimism.

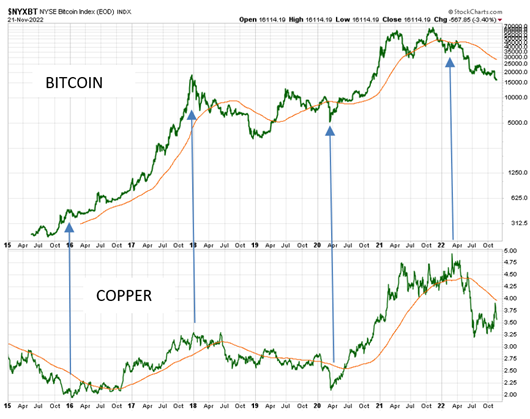

Bitcoin, like commodities, responds to trends in the business cycle and liquidity. The above chart shows the main turning points of Bitcoin correspond to the same turning points of copper, one of the most sensitive commodities to business cycle trends.

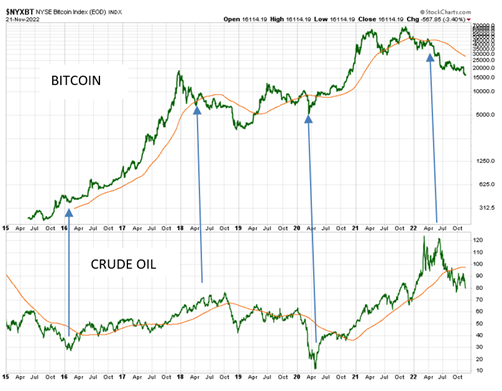

Bitcoin has also the same turning points as crude oil and most other commodities (see the above chart). The reason is commodities respond to changes in liquidity and business cycle trends. Commodities rise when the business cycle points to a strengthening economy. Commodities decline when the business cycle reflects a weakening economy.

Key takeaways

- The sharp decline of the growth of M2, the deep inversion of the yield curve, and excessive inventory accumulation point to much weaker economic conditions ahead.

- The business cycle is declining and is currently in Phase Four. The tightening of the Fed and the inventory correction will force commodities and Bitcoin prices to continue to decline.

- The price of Bitcoin will bottom when the business cycle moves into Phase One as the business starts ramping up production to rebuild inventories. This is the time most other commodities are also rising, responding to the Fed’s easing that took place in Phase Four.

- This analysis suggests Bitcoin price behavior is not independent of the vagaries of a central bank monetary policy and changes in the business cycle. The reason is its price is affected by changes in the liquidity created by the banking system.

Learn more about George & The Peter Dag Portfolio here