Covered call writing is defined as first purchasing or already owning the underlying security and then selling the corresponding call option, states Alan Ellman of The Blue Collar Investor.

By doing so, we are protected; we know our cost basis. A BCI member proposed to me an extreme bear market strategy where a deep out-of-the-money (OTM) call is sold first and if the stock appreciates significantly, against the market trend, we can buy that security prior to the strike moving in the money. This article will analyze the pros and cons of such an approach.

Real-life Example with S&P 500 ETF TRUST ETF (SPY)

- 6/17/2022: SPY trading at $365.40.

- 6/17/2022: The $400.00 deep OTM 7/18/2022 call shows a bid price of $1.56 per share.

- 6/17/2022: Sell the naked call first and plan to purchase SPY if the price appreciates near the $400.00 strike.

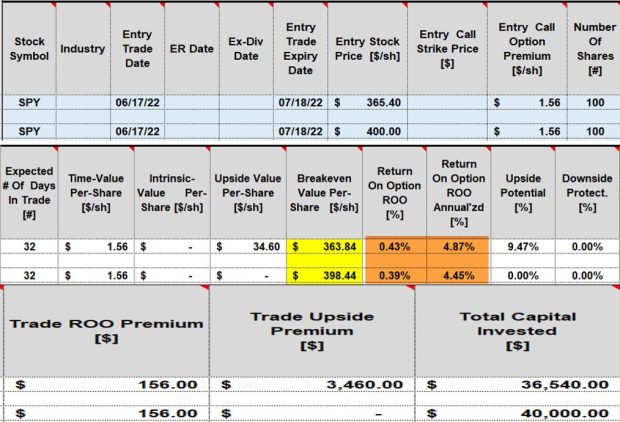

BCI Trade Management Calculator Showing Initial Returns at the Current and $400.00 Price Points

SPY: Reverse Covered Call Writing Calculations

The annualized returns, whether shares are purchased or not, are between 4% and 5% (brown cells).

Strategy Advantages

- In a bear market, holding long positions can result in significant losses.

- Selling low-Delta, deep OTM calls have a low probability of exercise.

Strategy Disadvantages

- The upside is the premium generated for a deep OTM call strike which, by definition for a security like SPY, would be minuscule.

- If we are forced to buy the security as price approaches the deep OTM strike, the % return would be similarly minuscule, even a bit less (brown cells for the first two bullets).

- Naked option trading requires a higher level of trading approval that most retail investors would have a difficult time obtaining.

An Alternative Consideration

Sell deep OTM cash-secured puts that generate a pre-defined initial time-value return goal range because we know our cost basis in advance (the cash required to secure that put trade). In this case, if the trade does turn against us and the share price declines below the put strike, shares are purchased at a discount from when the trade was initially executed.

Discussion

There are many ways to craft our option-selling portfolios in extreme bear market conditions. Naked option selling is not appropriate for most retail investors, even with a plan to purchase the underlying should the trade turn against us. In addition, it would be difficult to receive approval for such trading.

Learn more about Alan Ellman on the Blue Collar Investor Website.