Yesterday was Fed Day, and once again we hear plenty from the financial media about just how “hawkish” monetary policy has been this year, states Jesse Felder of TheFelderReport.com.

To be sure, the Fed has raised rates at a faster pace than we have seen in recent history. However, given where the rate of inflation sits today, it’s hard to argue that monetary policy has, in fact, been hawkish relative to similar periods in the past.

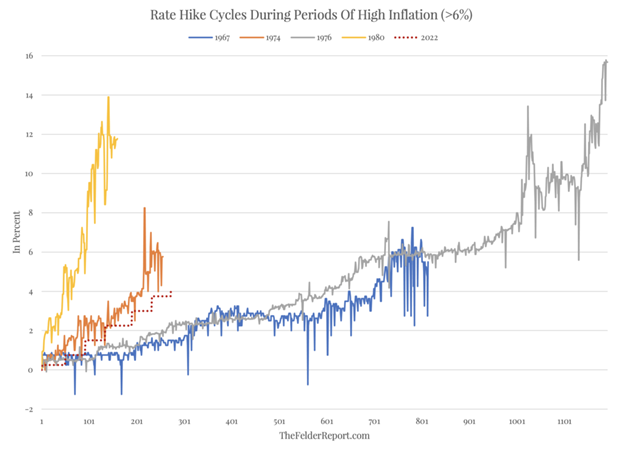

The last time inflation posed as big a problem as it does today (with headline CPI above 6% for an extended period of time), the Fed either raised rates at an even faster pace than Jay Powell & Co. have done this year (in 1974 and 1980) or the central bank maintained a policy of continuous tightening for far longer than we have seen so far (in 1967 and 1976).

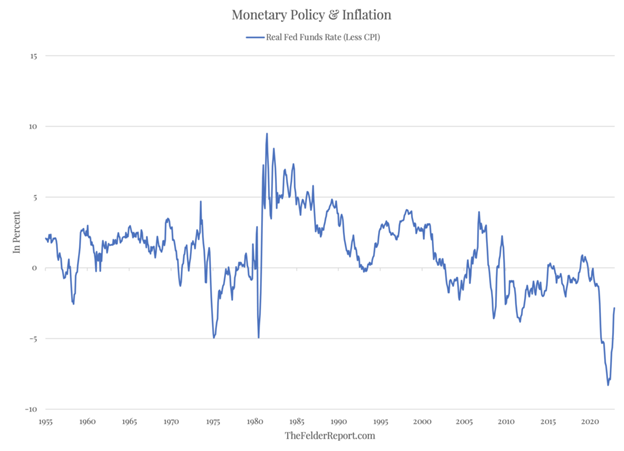

Moreover, each one of these rate hike cycles of the past took the fed funds rate above the rate of inflation (if it wasn’t already there), sometimes significantly above, and in relatively short order. Even after the rate hike, 273 days into the hiking cycle, the real fed funds rate remains more deeply negative than at almost any point in the past half-century.

The truth is that Arthur Burns, chair of the Fed from 1970-1978 and widely considered the “worst” in history due to his letting inflation run out of control, never pursued monetary policy so aggressively dovish as that we have seen this year. From my perspective, until we see a fed funds rate significantly above the rate of inflation and one that is maintained at that level for a prolonged period of time (years not months) it’s hard to argue today’s fed is truly hawkish.

Learn more about Jesse Felder at TheFelderReport.com.