With the major indexes below overhead supply, you're seeing the choppy action, states JC Parets of AllStarCharts.com.

There are stocks continuing to do very well, like Homebuilders for example. And there are some stocks really struggling, like US Banks. But in the aggregate, at the index level, you're seeing the grind. We've discussed the implications of these levels and why a more neutral approach to the indexes in the short term remains best. But here's what it looks like today. This resistance, not only represents a key extension from the 2020 declines, but also the AVWAP from the all-time highs, and the 200-day moving average:

There are a lot of reasons for chop near these prices. And you can see something similar in the Dow Jones Industrial Average. There's a reason why 34,500 was our upside target. For the time being, our neutral approach continues to be best if we're below these levels:

There are a couple of things to point out here. First of all, as important as these levels had been in the past, and as important as these levels had been to us as we approached them recently, I would say that the market has now reinforced just how critical these prices really are - for both the S&P 500 (SPX) and Dow Jones Industrial Average.

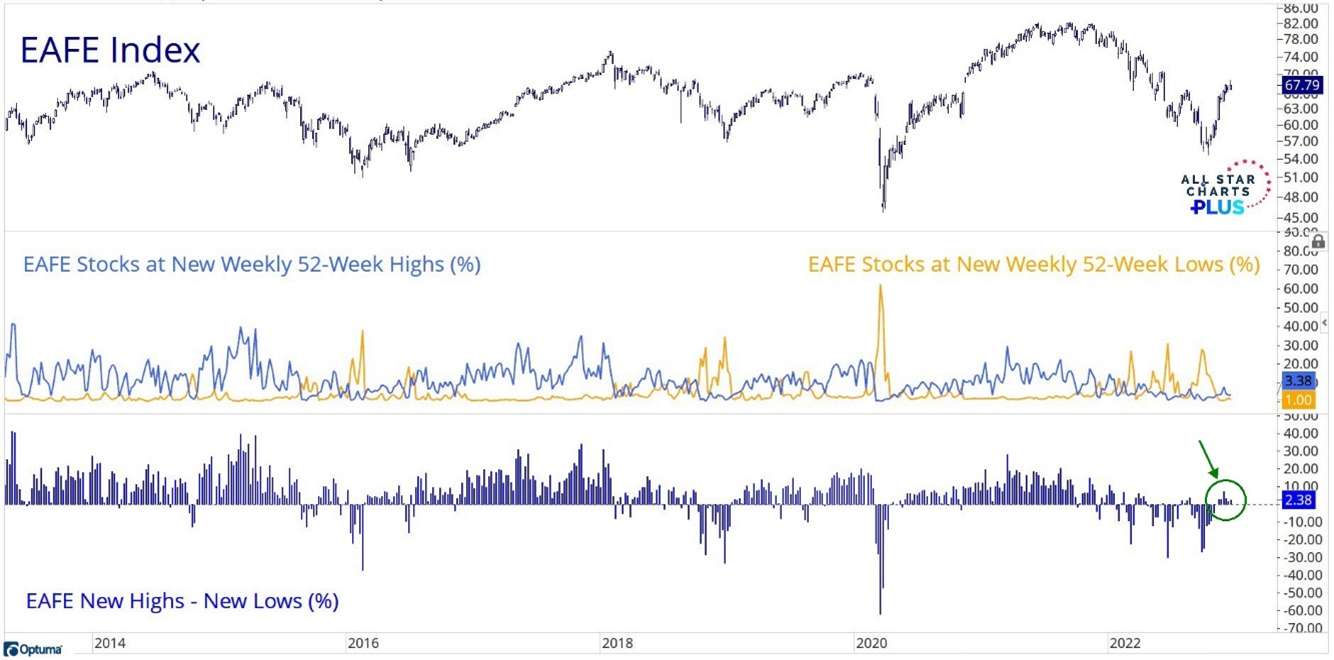

So, while this chop may be frustrating for long, I think the implications of a future breakout if/when it comes will be that much more important. It's not just that these levels were once resistant. It's that now with further recognition of these levels, the market is reiterating that yes, in fact, all eyes need to be on these prices. Remember stocks are a global asset class with opportunities in ETFs and ADRs that trade in the US with plenty of liquidity that gives us exposure to other countries. We keep seeing more and more strength coming from International Stocks. In fact, we're actually seeing more stocks in developed countries outside the US making new highs than new lows.

In the meantime, do you know who doesn't care whether stocks go up, down, or even sideways?

To learn more about J.C. Parets, please visit AllStarCharts.com.