This market environment is not like others that came before it, states JC Parets of AllStarCharts.com.

Remember people used to complain that only five stocks were driving the market? Now they complain that those five stocks aren't working, but many others are. And that's the point. With new environments comes new leadership. We've seen this happen over many decades. And those five stocks that everyone used to complain about were driving the market, have now been laggards for quite some time. I think people just like to complain.

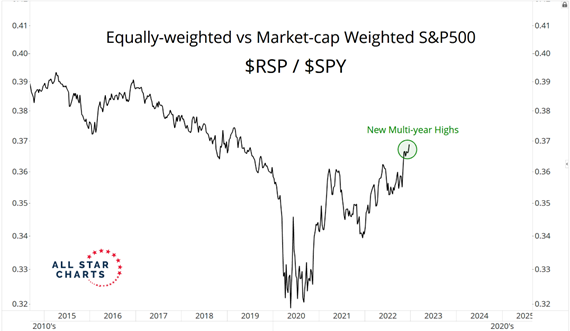

If you're like us and would rather look for opportunities to profit instead of just complaining all the time, then it's important to look underneath the surface. A great way to visualize broader leadership vs just a few names is in the equally-weighted chart of the S&P 500 (SPX). This eliminates those mega-caps from dominating the indexes.

Here's how that looks compared to the market-cap weighted version:

You can see the same phenomenon in the Nasdaq. Look at the equally-weighted index also making new multi-year highs relative to its cap-weighted counterpart.

Both charts are making new highs. To me, this means that we want to continue to be more sector-specific when it comes to our buying decisions. For those of you following along, this is nothing new. The S&P 500 and Dow Jones Industrial Average have been stuck below overhead supply, hence our more neutral approach to those indexes.

If you're only following the indexes, you may be one of those people who have been missing out on all the opportunities popping up in what could potentially be a new bull market. It's less about the indexes and more about the stocks. That's the theme that keeps working.

To learn more about J.C. Parets, please visit AllStarCharts.com.