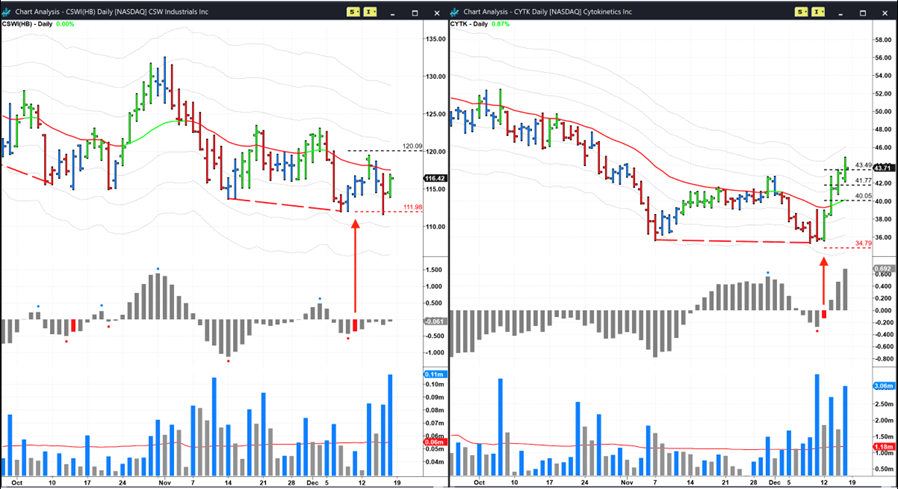

Last Monday’s note drew attention to a swing trade on CSW Industrials (CSWI) but it was stopped out on Thursday, writes Ian Murphy of MurphyTrading.com.

This chemical manufacturer made an attempt to rally after the trigger but lacked the momentum to reach even the first target before reversing sharply and piercing through the initial protective stop (left below).

Later that afternoon another setup crystallized on Cytokinetics, Inc. (CYTK). The divergence looked better than CSWI, but the volume was not ideal. However, this trade was a totally different kettle of fish and exploded off the line and never looked back. All three targets have been reached for a profit of 8.9% and the stock is up 0.8% in pre-market trading, implying there may be more gas in the tank.

Daily swing trading has a win rate of 50-60%, so we should expect half of all these types of trades not to work out. In practice, about 20% of losers hit the first target before reversing, so ‘losing’ trades could be called ‘breakeven’ or ‘half-winning’ trades. For this reason, we should concentrate less on the win rate and more on the slope of our equity curve.

Learn more about Ian Murphy at MurphyTrading.com.