There is scant sign of a ‘Santa Rally’ this year, but I wouldn’t give up hope just yet, writes Ian Murphy of MurphyTrading.com.

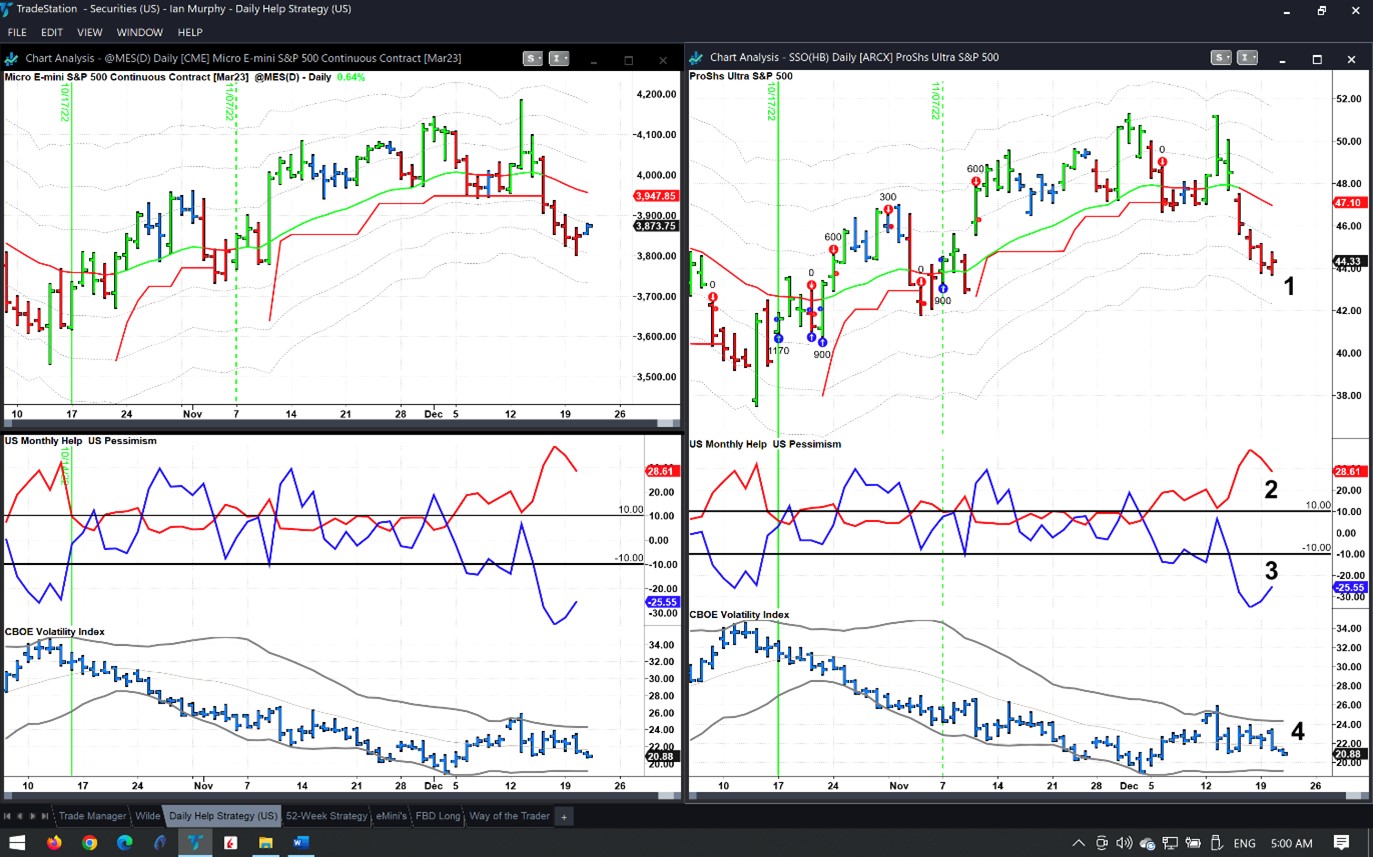

It’s highly likely we will get a Help Strategy trigger before the week is out, and possibly as soon as today.

The required signals are starting to line up, beginning with a washout and reversal of price (one). The Pessimism and Help indicators (two and three) have expanded well and are starting to contract as the number of new 20-day lows falls. Cboe SPX Volatility Index (VIX) is trending down (four) and is back below the center line. However, we are still in a bearish trend so any trigger should be scaled out fully at three targets.

Source: stockcharts.com

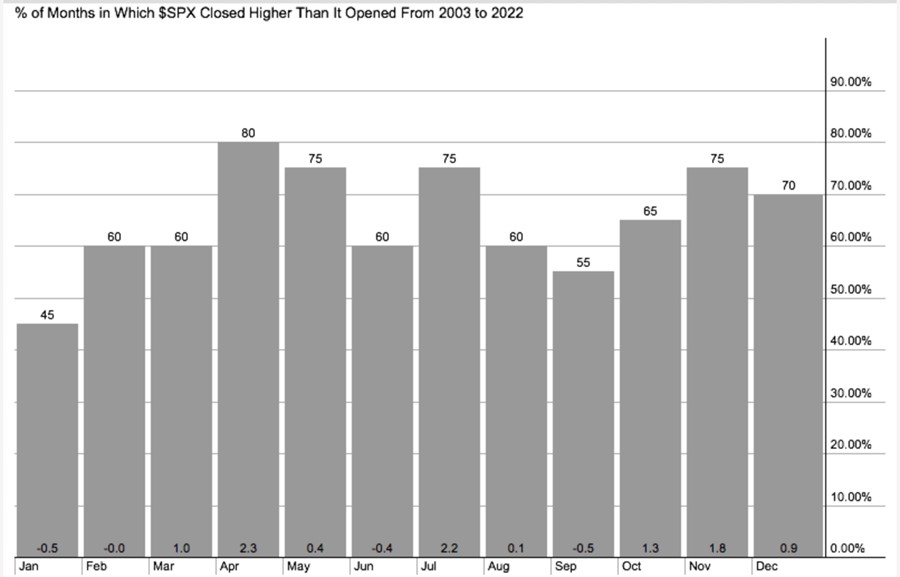

An analysis of seasonality also supports a scaled approach because the S&P 500 (SPX) closed higher than it opened 70% of the time for the past 20 years, but January has been the worst-performing month closing lower than it opened 45% of the time.

Learn more about Ian Murphy at MurphyTrading.com.