Declining wage growth in Friday’s nonfarm payroll data boosted equity prices on the assumption inflation is slowing in the US economy, writes Ian Murphy of MurphyTrading.com.

The question now is, ‘Will the gains continue this week?’ And an even bigger question is, ‘Is the bear market over?’ Personally, I hope not! Given the choice, I would prefer a deeper washout of the October lows because I don’t believe we are even remotely close to a point of capitulation which would form a solid bottom and set up a new bull market for another five or ten years.

Having said that, we rarely get what we want in the market so we must deal with the constant uncertainty of what we have (but don’t like), as opposed to what we would like (but don’t have). Therefore, I must accept this might be a turning point in stocks and I must take the message the indicators are giving at face value. If I am right, some money will be made, if I am wrong, protective stops will limit the damage.

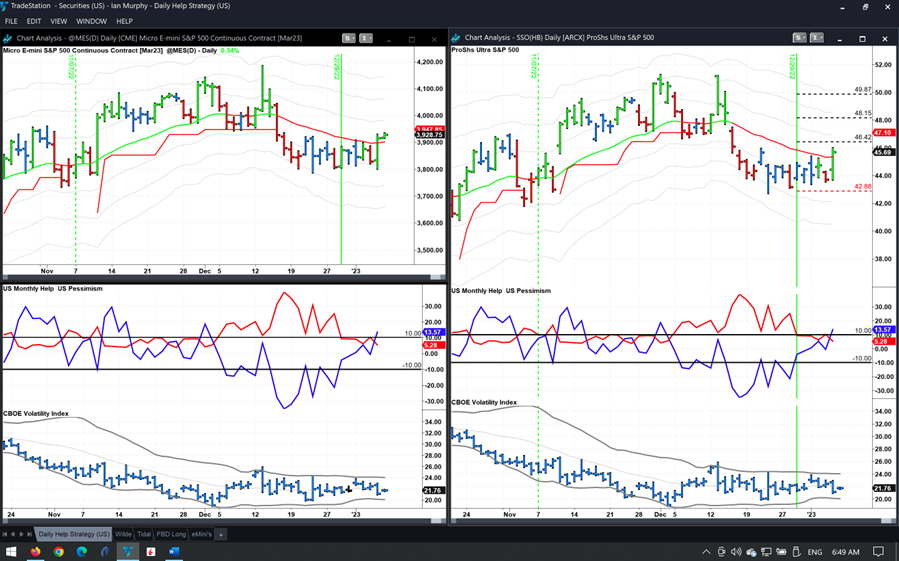

The Help Strategy got a boost on Friday but still fell short of the first target (top right on the chart). As mentioned in Thursday’s webinar, a decision needed to be made on Friday afternoon to stay in this or not. If you are still in, it looks as if T1 may be hit today based on pre-market prices.

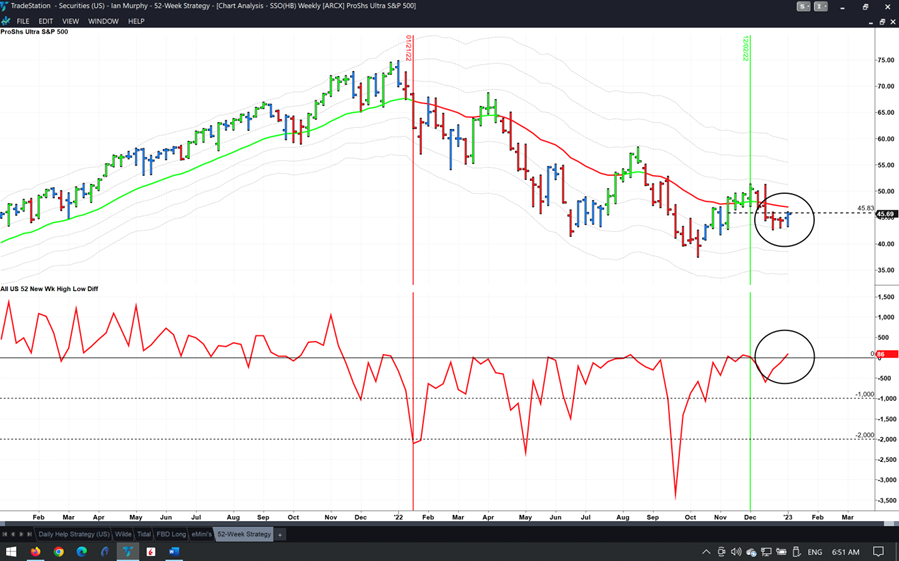

A similar story is unfolding on the 52-Week Strategy. The lackluster sideways trend of the past few weeks may have formed a first higher low pattern. Last week’s bar recovered as it changed from red to blue and almost closed above the 50% retrace line. In addition, the high-low indicator closed above zero, these are two very positive signs for the trade—so far, so good!

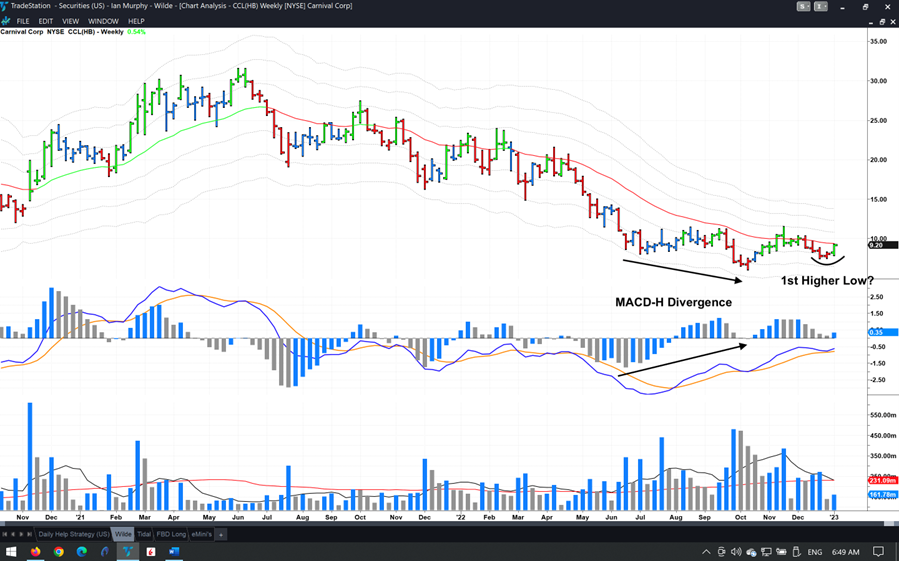

Finally, the Weekly Trend Following setup in Carnival Corp. (CCL) which was mentioned in the webinar finished the week strongly. The entry price was $9.20 with the initial protective stop at $7.92 on a weekly closing basis—earnings on this are due around March 22.

Learn more about Ian Murphy at MurphyTrading.com.