The flow of earnings will pick up noticeably from today onwards and reach a crescendo next week as we move into February, writes Ian Murphy of MurphyTrading.com.

According to Refinitiv, 29% of S&P 500 (SPX) firms have already reported for Q4-2022 with 67.8% showing earnings above market expectations compared to a long-term average of 66%. Time will tell if the current quarter holds up as well.

Also this week, the Fed will announce their latest interest rate decision on Wednesday with a hike of 0.25% anticipated. On Thursday, the ECB and Bank of England will join the party with both expected to increase the cost to borrowers by another 0.5%. These rate increases are priced into stocks already and traders are questioning when the size and frequency of hikes will begin to slow and eventually top out, but in the meantime, the trend in rates is still up!

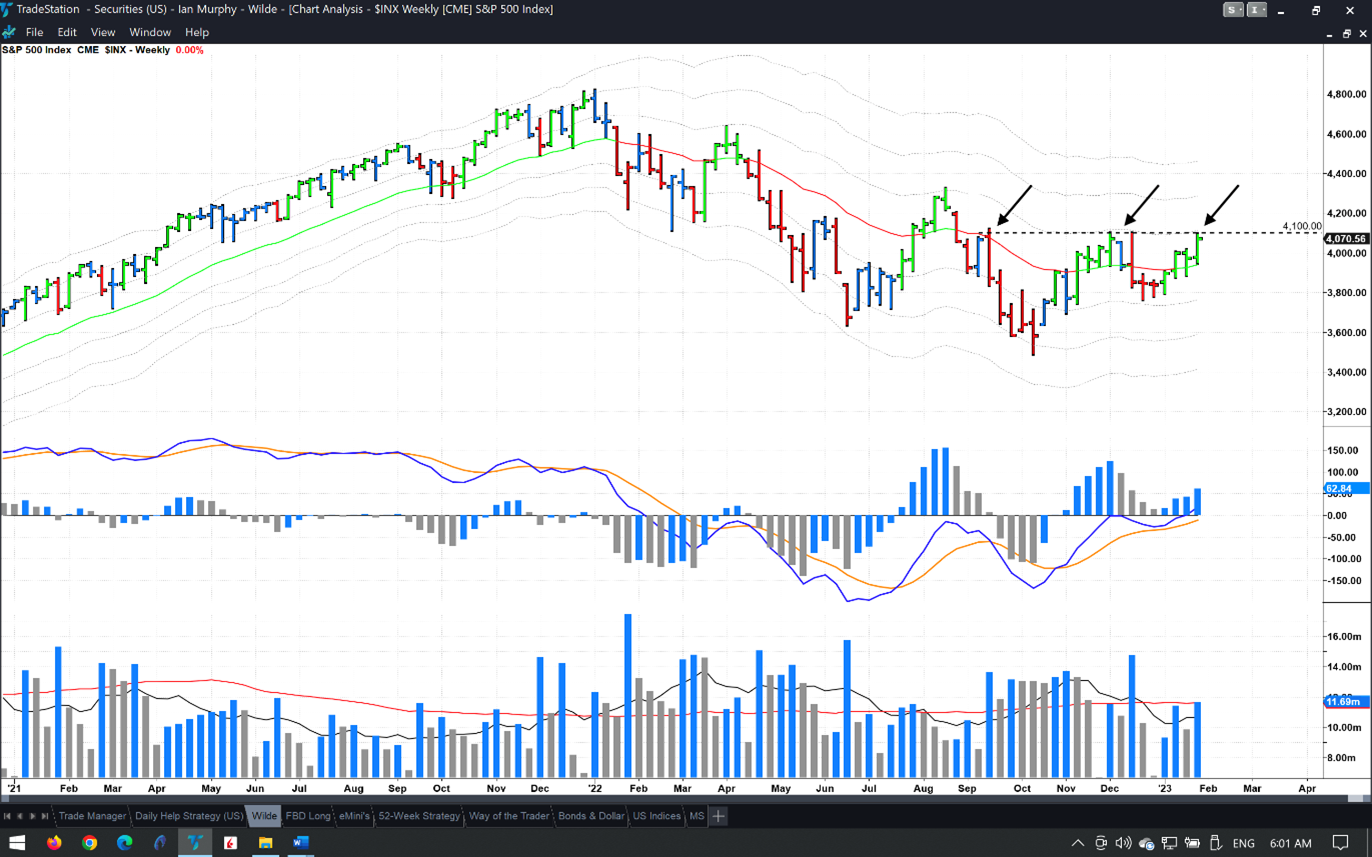

Meanwhile, the S&P 500 is challenging overhead resistance at 4100(ish) for a third time. This level is where the battle between bulls and bears will be won or lost. Coincidentally (or maybe not) this level is also where the 1ATR line on a weekly chart has been sitting since October.

Remember, a market trading above the weekly 1ATR is technically bullish, so the moment of truth has finally arrived for the US stock market!

Learn more about Ian Murphy at MurphyTrading.com.