We take a look at a possible daily swing trade setting up in Consol Mining Corp. (CEIX), writes Ian Murphy of MurphyTrading.com.

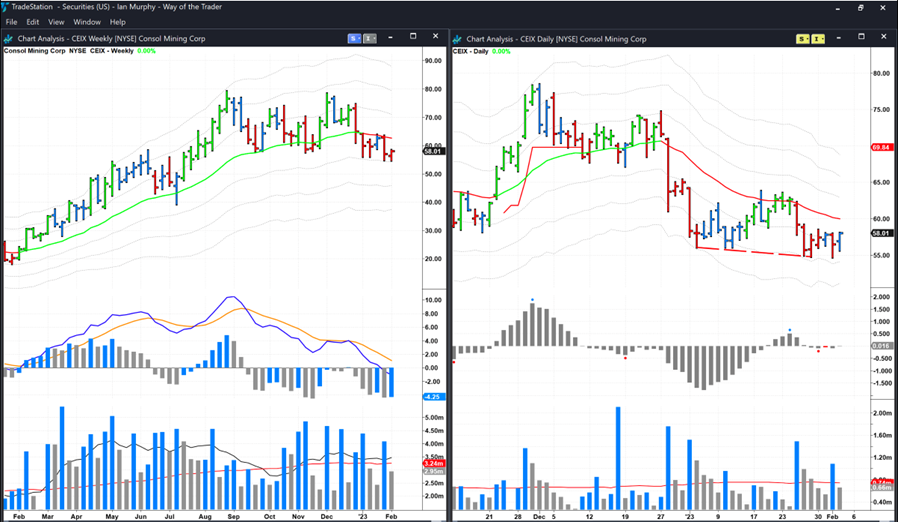

There might also be a weekly trade in play. On the weekly chart (left) this coal producer has had an incredible bull run since it last closed below the -1ATR line in November 2020, but the price has pulled back to that line recently.

On the daily chart (right) we have a false downside breakout on price with a bullish divergence (FBD). This week’s low of $54.68 would need to hold as support from here on, so under that level is where the initial stop should be. Technically $54.14 is where it would be based on a setting 0.5ATR below the low of yesterday’s price bar.

On the weekly chart, the -1ATR is at $54.27 and a close below that would mean an exit, so the stop for both timeframes is almost identical, and this would be typical when we get a good entry on a pullback. A word of caution, earnings are due next Tuesday before the market opens.

Learn more about Ian Murphy at MurphyTrading.com.