Stock market bulls have been rewarded over the past three months. Remember, historically these are the best three months of the year—November through January. And then comes the hangover, states JC Parets of AllStarCharts.com.

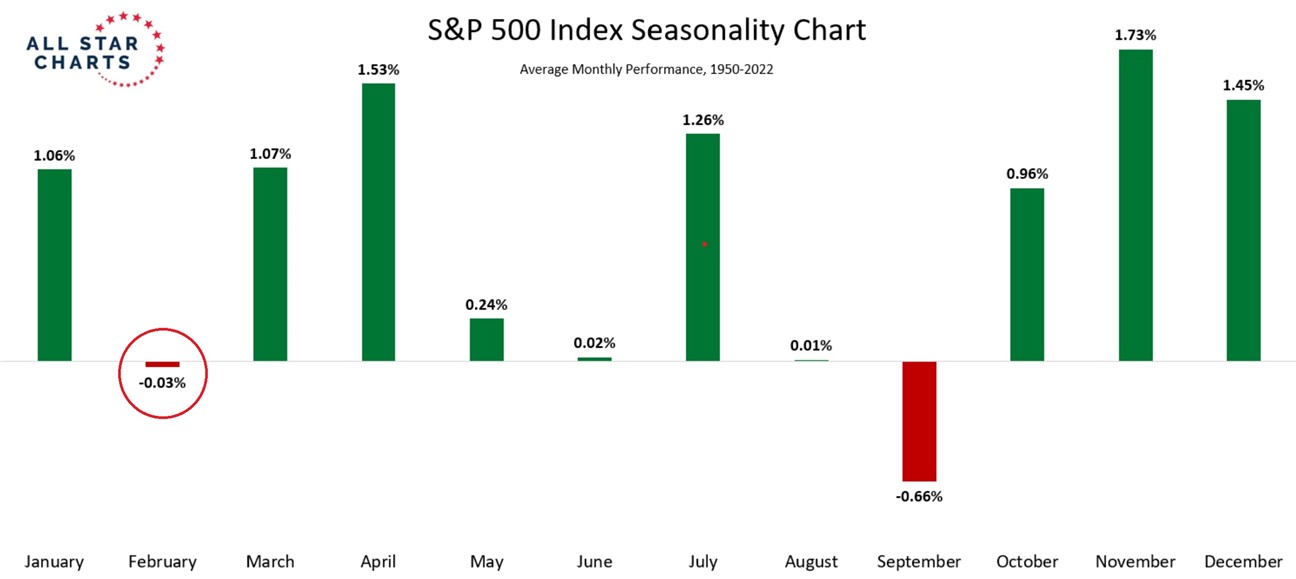

Think about those last three months. Did you see people having a good time? Were some having a little too much fun? Would you agree there was some disorderly conduct? Were participants behaving as if they were under the influence? You bet. And this sort of behavior is normal for this time of the year, and the entire four-year cycle for that matter. But then comes February—one of the worst months of the year.

People partied a little too hard and now need to chill out and rest. That’s historically what happens next. Now, obviously, we have no idea what the stock market is going to do, even if all the data historically suggests this is the time when it takes a breather. Current price trends are still priority number one. The probabilities support a month where stocks struggle. It doesn’t even mean they all need to go down. It can also be a period of consolidation.

So what’s the catalyst? What would put some pressure on stocks, to support those seasonal trends? I think it’s the Dollar. Look at that whipsaw.

From failed moves come fast moves in the opposite direction, which is how I learned it. If you’re looking for stocks to come under some pressure, I think this should be front and center. Also, notice the bullish divergence in momentum.

Listen, I think price trends in stocks have been changing for the better for quite some time now. I’m not necessarily sure that any digestion of gains this month is a bad thing for those longer-term stock trends. But I do think it’s important to recognize that there are different trends on different time horizons.

While longer-term we’ve seen tremendous improvement over the past seven months, we also recognize there are opportunities on the short side of stocks if there is a true catalyst to get them going. I think that catalyst would be a stronger dollar if this is indeed how it all plays out. We shall have to see.

But the probabilities do favor a tougher month for stock market bulls. I would focus on how individual stocks and sectors are acting, more so than the large-cap indexes like the S&P 500 (SPX) and Nasdaq and Dow, because they’re all mostly in messy ranges anyway. It’s the sectors and stocks themselves that should continue to give us the insight we need.

Hell, they’re the ones that got us here. If it wasn’t for all the analysis we do on stocks and sectors, we would have been like the rest of the uninformed and thought stocks were in a downtrend all this time. Wouldn’t that have been a real shame? It continues to be a weight of the evidence thing. Make sure you’ve defined your time horizon. This is as important as ever!

To learn more about JC Parets, please visit AllStarCharts.com.