Small-cap stocks have been outperforming since last summer, states JC Parets of AllStarCharts.com.

The outperformance has certainly continued in 2023. For one, small-cap stocks tend to have less of a correlation with the overall market than their larger-cap counterparts. But one of the things I really like about this group is the fact that institutional accumulation can't hide. If there is real buying taking place, the relative strength will show up. There's only so much to go around in these smaller-cap stocks.

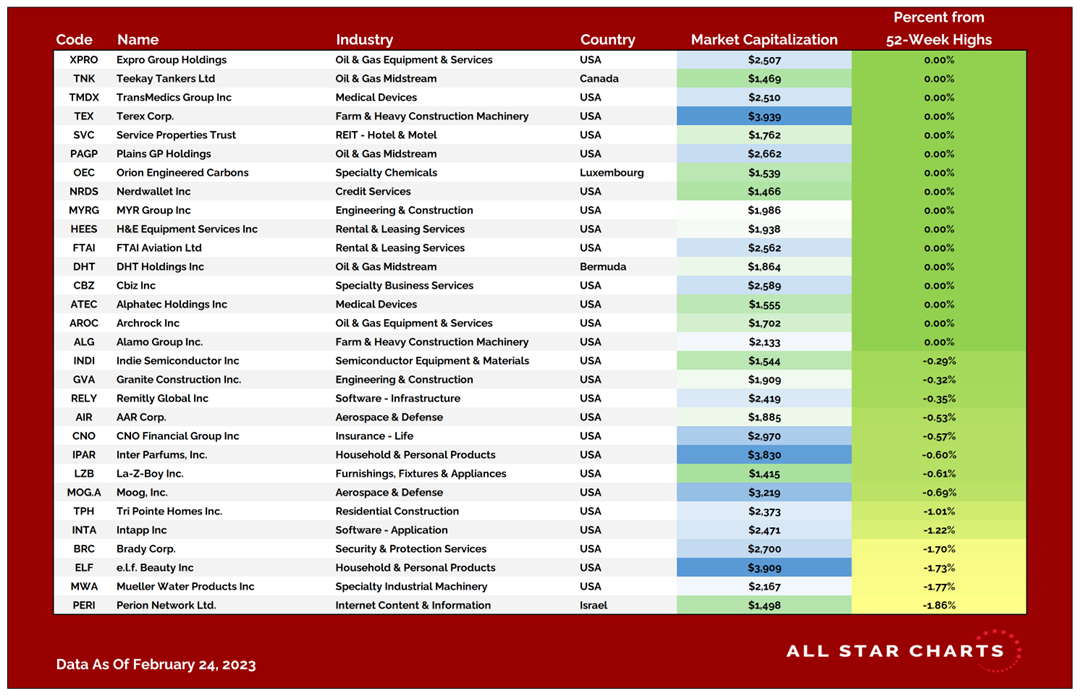

One thing we've done is change the rules. Traditionally, small-cap has consisted of stocks between $300M - $2B market cap. But that makes little sense these days. So, for us, small-caps are between $1B - $4B market cap. Here is our latest Minor Leaguers Report:

Since we sort our list by proximity to 52-week highs, the names toward the top are potential future leaders. They’re not just exhibiting impressive relative strength. They’re also making new highs on an absolute basis.

To learn more about JC Parets, please visit AllStarCharts.com.