As expected, Friday’s strong performance in US equities triggered a few trades, states Ian Murphy of MurphyTrading.com.

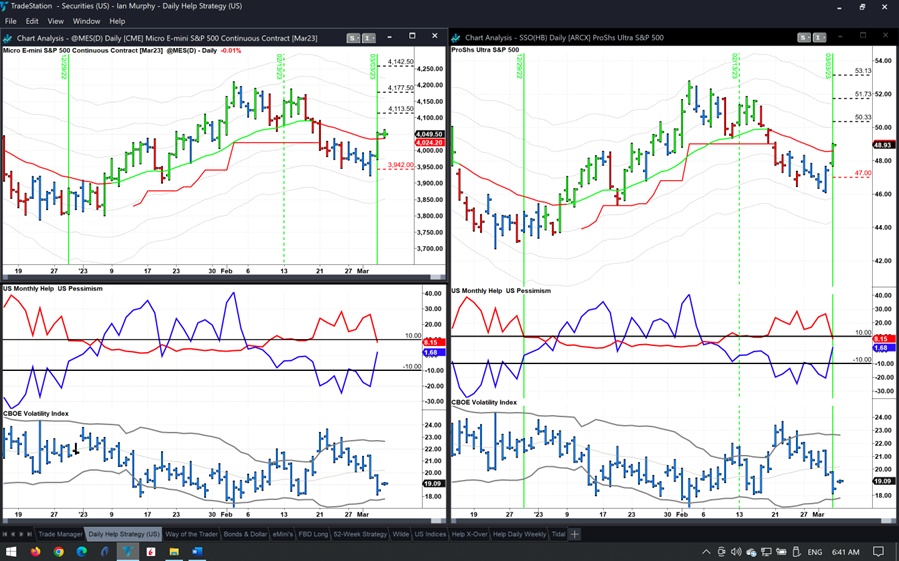

Beginning with the Help Strategy (a daily swing trading approach with optional trend-following elements), there was a valid trigger on Friday, as the total number of US stocks making new low prices for the past 20 days declined markedly.

The initial protective stop and targets on ProShares Ultra S&P500 2x Shares (SSO) and Micro E-minis are shown above (futures orders are rounded down to the nearest tick size).

The weekly trend following 52-Week Strategy is a pure play on the overall US market. It provided an opportunity to re-enter on Friday if the original entry on December second was missed. The soft protective stop on SSO is $44.43 based on Friday’s close as shown above with the dashed red line. Note how the indicator is back above zero. In terms of targets, the sky is the limit on this one!

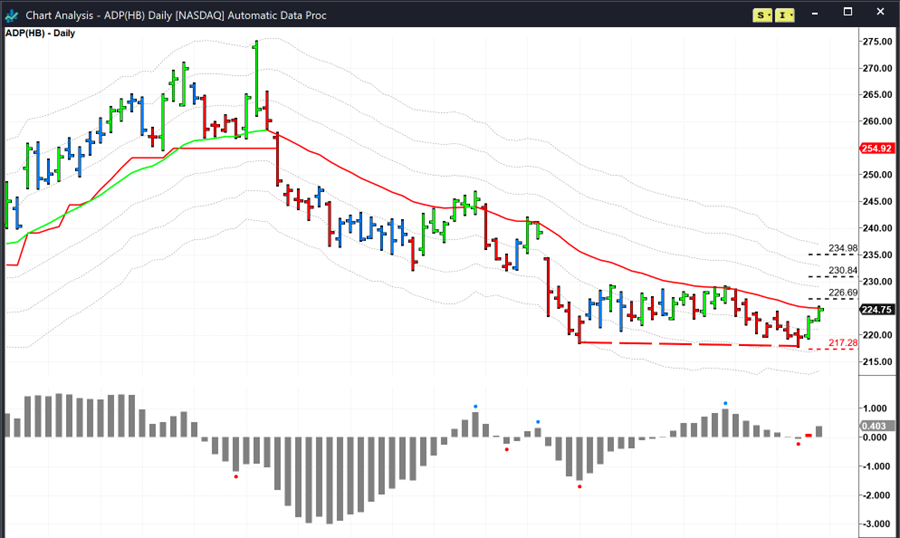

Finally, Automatic Data Processing, Inc. (ADP) had another positive day after Thursday’s trigger. Earnings on this one are not due until the end of next month, so there is no concern on that front for the moment. Now that we’ve had these triggers, we need to see follow-through on these trades and ideally, targets will be hit during the week ahead.

Learn more about Ian Murphy at MurphyTrading.com.