Over the weekend in Switzerland, it appears UBS Group AG Registered (UBS) and Credit Suisse banks were forced into an arranged marriage in an attempt to salvage what’s left of the latter’s reputation, states Ian Murphy of MurphyTrading.com.

A never-ending stream of scandals seriously damaged Credit Suisse, and regulators had to act. Bond holders have been badly burned and this casts a shadow on future funding for other banks. In addition, leading central banks agreed to boost liquidity on Sunday in a unified global move similar to what happened at the beginning of the Covid outbreak.

Traders (being extreme pragmatists by nature) are now wondering if recent banking woes are isolated events or is there a serious problem at the heart of global banking, which has yet to emerge. Comparisons are being inevitably drawn to 2008. Against this backdrop, we can expect markets to remain firmly in “risk off” mode in the run up to Wednesday’s rate decision by the Fed.

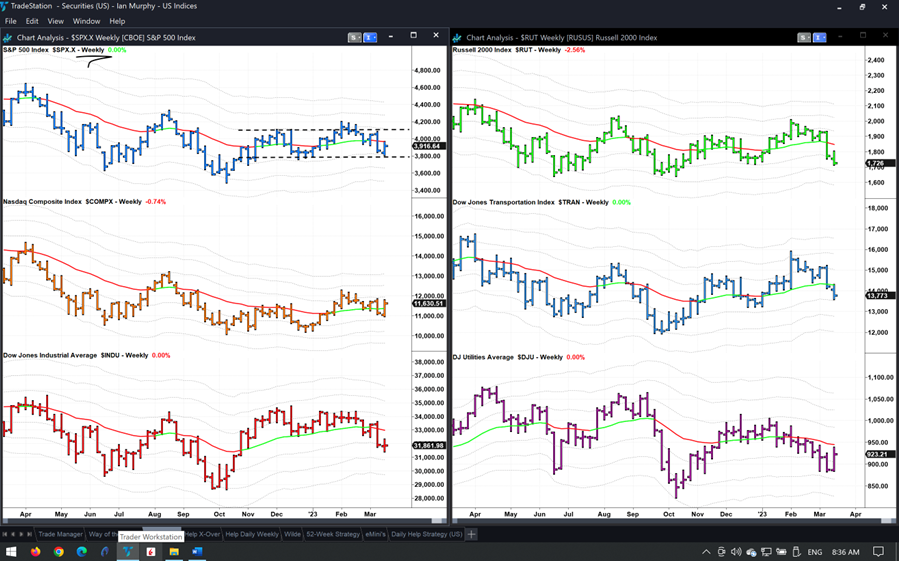

A semi-crisis in banking could be the catalyst to end the current indecision between bulls and bears where the S&P 500 (SPX) has been trending sideways in the neutral zone on a weekly chart since last October (dashed lines above). A full-blown crisis could propel a deep washout of the lows from which a new bullish trend could emerge—let’s see! For the record, I’m not calling for a banking crisis (I have savings too) but something needs to shake this market to life.

In the meantime, we should only take “Grade A” trading setups and ensure protective stops are in place while reducing position sizes on trades. It might also be no harm to ensure our savings are in “too big to fail” banks and/or under the threshold covered by government guarantee.

Learn more about Ian Murphy at MurphyTrading.com.