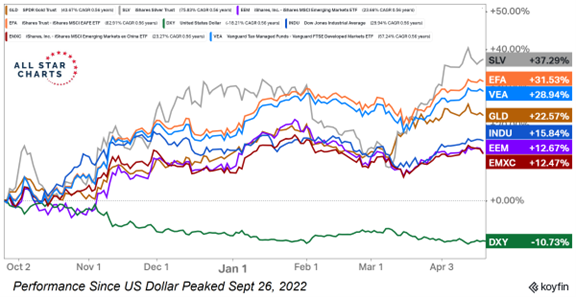

The weakness in the US Dollar over the past couple of quarters comes as no surprise to us, states JC Parets of AllStarCharts.com.

The journalists nailed it again. What else is new? Here's what really surprised me. If you would have told me in September that the Dollar would fall apart over the next two quarters, I would have told you that precious metals are likely doing well in that environment. I would have also said that Silver would outperform Gold during that period.

In this case, I would have been absolutely right. Great. What I would have also been confident about is foreign equities doing well in that weaker Dollar environment. And while I would have also been correct in that guess, I would have definitely told you that it would be Emerging Markets outperforming, not Developed Markets. And that would have been very wrong.

It's been the Developed Markets outside the US that have been dominating the equities markets over the past couple of quarters. Look at the performance of these assets since the Dollar peaked:

iShares MSCI Emerging Markets ETF (EEM), with or without iShares MSCI Emerging Markets ex China ETF (EMXC), are dramatically outperforming their developed market counterparts. It’s not even close. And so, when markets do something this unexpected, I pay much closer attention. How could I not?

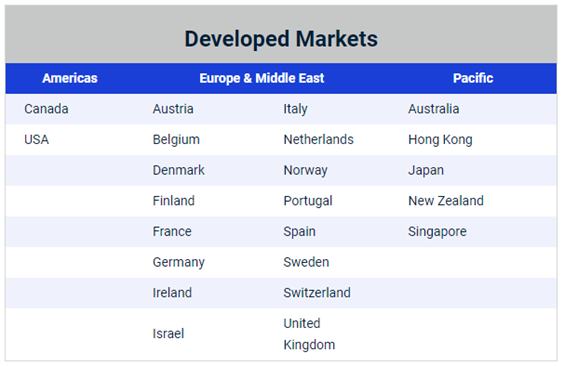

Here's the list of MSCI Developed Markets:

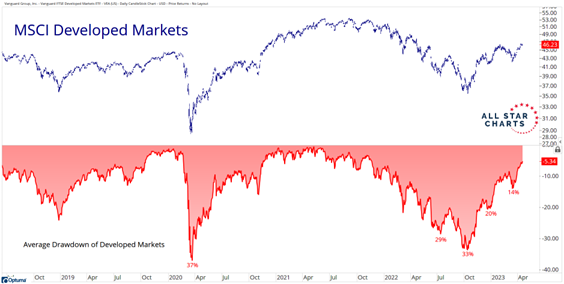

The strength of this group has been off the charts. You can't deny it. Look at the average drawdown from all-time highs among Developed Markets. The average country is only 5% from new highs:

You can see the Vanguard FTSE Developed Markets ETF (VEA) here below closing last week at new 52-week highs. The ETF is at a key retracement based on the 2021-2022 sell-off so this level is front and center:

We're seeing a lot of new all-time highs for an environment that some people claim is a bear market. New highs are characteristics of bull markets. Just because the US is underperforming this cycle, doesn't mean it's a bear market. In fact, go back and study all of the bull markets over the past 100 years. Do you know what you'll find? The US underperformed other countries quite often during all those bull markets. This is normal.

To learn more about JC Parets, please visit AllStarCharts.com.