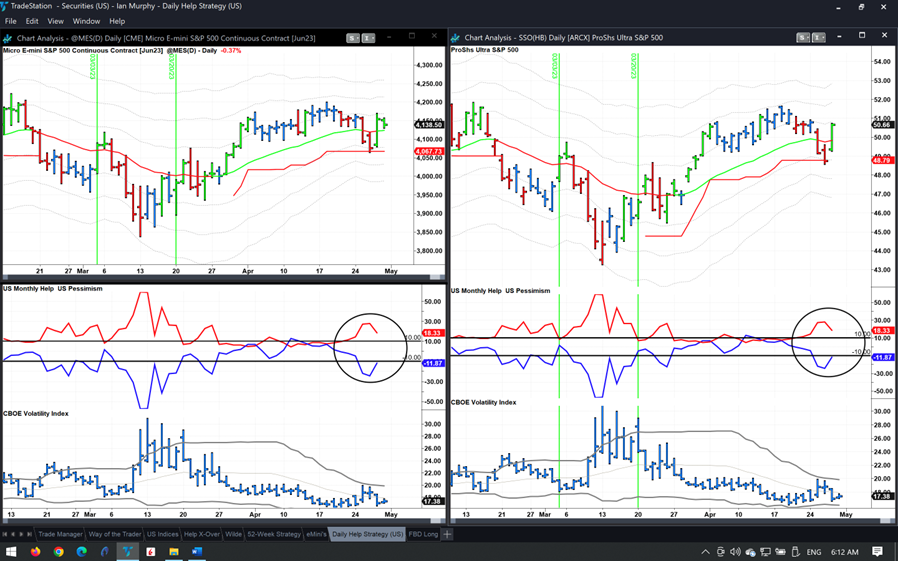

As it happens, the Help Strategy did not trigger yesterday. The number of US stocks making or repeating new 20-day lows increased steadily throughout the session and ended at 18.3%, states Ian Murphy of MurphyTrading.com.

Apart from Pessimism and Help, everything else lined up perfectly. Pessimism (20-day lows) must get back below 10% because that’s the only way we know the bounce is broad-based and not just happening among the 500 elite stocks in the S&P 500 (SPX). These important indicators (circles) need to get back into the channel or the trade is not on.

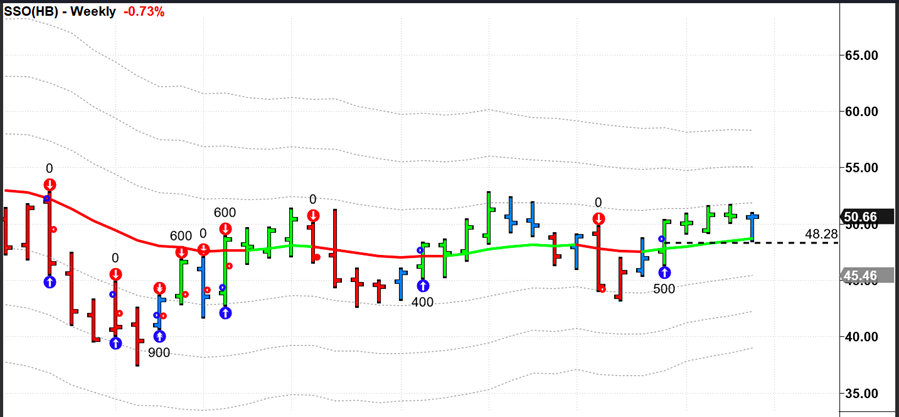

Also using ProShares Ultra S&P500 2x Shares (SSO) but on a longer time frame for the 52-Week Strategy, I like the way this week’s price bar appears to be finding support at a 50% retrace of the bar on which I entered (dashed line). If this holds true today, it will be a positive sign.

Learn more about Ian Murphy at MurphyTrading.com.