It was interesting to sit back and watch the commentary during April about sector rotation and "should investors be in or out of equities," and all the while a few good strategies grabbed profits while people were debating what to do, states Ian Murphy of MurphyTrading.com.

As the saying goes, if you wait for the perfect conditions, you have already created the perfect distraction. A good chef can make a delicious meal from a handful of simple ingredients. Likewise, the market constantly provides opportunities and successful traders know how to manage a position simply and how to make the most of what little the market offers. Time and again I have seen clients find a strategy they can work with only to see them struggle because they are unable (or unwilling) to manage open positions correctly—they struggle with the simple things.

The Help Strategy is a pure play on the US equity market using a daily swing trading approach which gains exposure to stocks via a geared Exchange Traded Fund (ETF) or futures. Last month’s newsletter highlighted a position that had been open for just eight days, and it went on to be profitable before closing out during the month.

There are three recommended methods for managing positions on the ProShares Ultra S&P500 2x Shares (SSO) ETF and the trade performed differently depending on a trader’s risk tolerance and management skills. Resulting profits are shown below assuming an entry at the close on March 20 and orders were filled at the correct prices:

1. Carry the full position until stopped out: 4.8%

2. Scale out in thirds after three ATR moves to the upside: 6.5%

3. Scale out in thirds after two ATR moves to and trail the final ⅓ until stopped out: 4.7%

The entry and target prices are shown above, as is the trailing stop. The results were not spectacular, but a constant gain of five or 6% per month adds up nicely over the course of a year.

Support Shows Up

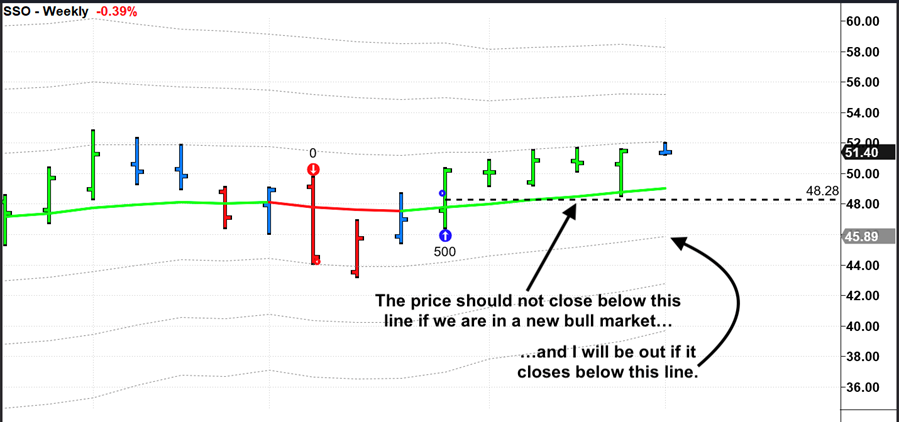

Continuing the follow-up on last month’s newsletter, the 52-Week strategy position is still open and has done nothing wrong. Interestingly, if we draw a 50% retrace on the price bar formed during the week in which I entered this trade, it now offers a new line of intermediate support.

In long-term weekly trend-following positions, it’s hugely beneficial to watch as each new line of support forms under the price. If and when the price starts falling, we will get an early warning signal when the most recent line is breached, so we need to sit up and pay extra attention as an exit might be approaching. This is especially useful if we have been sitting in a position for months or even years.

If we are indeed in a new bull market (jury still out), the 50% retrace on SSO should hold as support and we should not see the price close below that line. The soft trailing protective stop on a closing basis remains the same at the -1ATR line.

Learn more about Ian Murphy at MurphyTrading.com.