Sector Rotation is the lifeblood of a bull market, states JC Parets of AllStarCharts.com.

In the back half of last year, almost everything was working—except for some growth stocks and Tech. Then came 2023. The best performers have been growth stocks and Tech. That’s what we mean by “sector rotation”.

Last year they were all bitching about the fact that these Tech stocks and the Nasdaq weren’t working, even though practically everything else was. This year they’re complaining that these Tech stocks are the only ones working (hint: they’re not the only ones). Large-cap Tech outperforming does not mean that market breadth is weakening. It just means that Large-cap Tech is outperforming. This is classic sector rotation—a characteristic regularly found throughout bull markets.

So, what comes next? Rotation into sectors that were the initial leaders off the lows, which have consolidated their gains in 2023, would make sense to me. Industrials would be front and center there. Check out what consensus looks like for Industrials among market participants. They seem to all think this is a massive top:

But the way I see it, reversal patterns need something to reverse. Does this look like a massive uptrend and major reversal? There’s nothing to reverse here. This (among other things) leads me to believe that it is just a consolidation after the initial thrust off the lows.

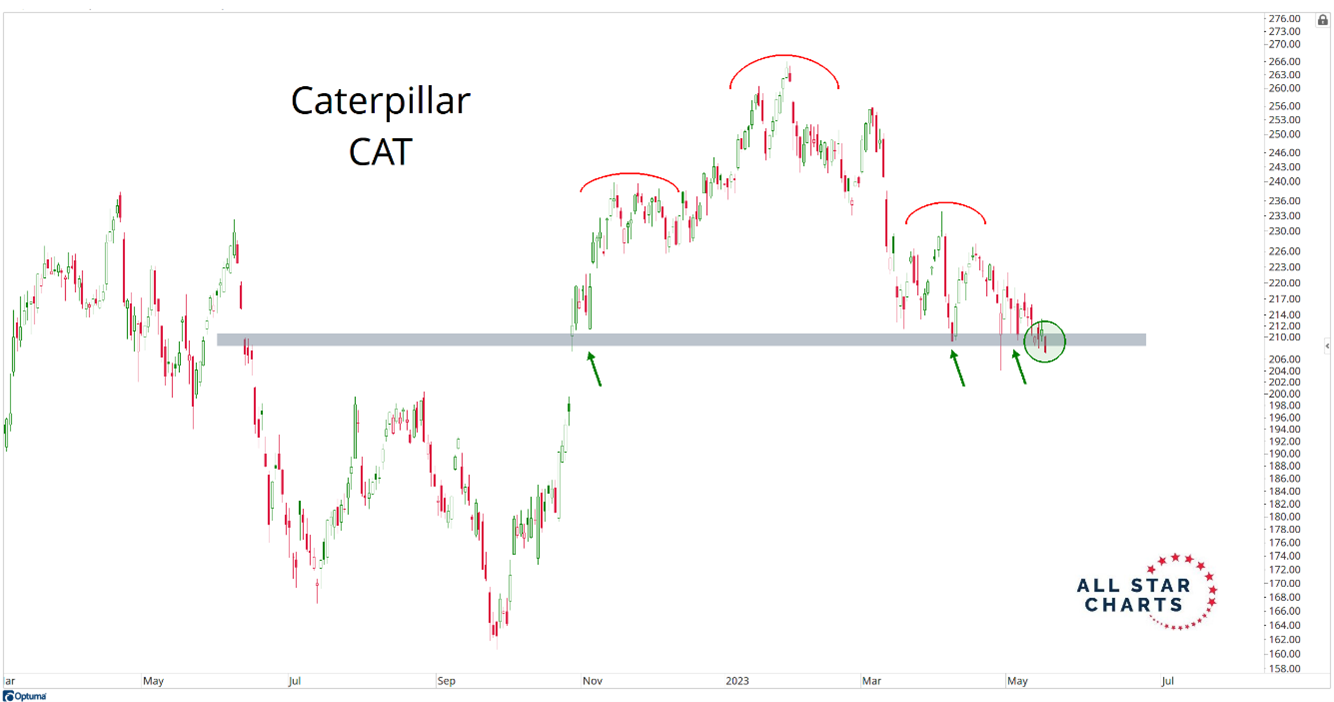

You can see the same thing in classic bellwether Caterpillar. This is one of the largest components in the Industrials Sector. Again, is this a massive top and reversal in trend? You need a prior uptrend to reverse. And there just isn’t anything there.

We’re buyers of CAT down here, betting that we will see further rotation in this ongoing bull market. This week marks the 11-month point since the new 52-week lows list peaked. It’s been relentless breadth improvement ever since. You can bet that rotation is not going to come, and perhaps a new bear market is going to begin. You can ignore all the data over the last year and tell yourself that this is still a bear market if you’re into masochism or something. But regardless of what you want to label the past 11 months, the question remains: What do we bet on now?

My bet is that the uptrends in price and the improvements in breadth continue. You can bet that the rotation stops and all of a sudden, completely out of nowhere, stocks start to fall. But that’s not what we’re betting on. I like Caterpillar long here.

To learn more about JC Parets, please visit AllStarCharts.com.