With the focus remaining firmly on the US debt ceiling talks, and key inflation data to come from both the UK and the US this week, the GBP/USD is clearly among the most interesting FX pairs to watch this week, states Fawad Razaqzada of Trading Candles.

US bonds have come under pressure again, underpinning their yields and the dollar. Meanwhile, the closely watched manufacturing PMIs out of Europe all disappointed expectations, while the services PMIs once again beat. With concerns over China continuing to rise, investors paid more attention to those weaker manufacturing numbers, causing base metal prices like iron ore and copper to drop further lower. Commodity dollars sold off along with European currencies, in the first half of Tuesday’s session.

US Dollar Upside Likely Limited

The US dollar index closed higher for the second consecutive time last week, thanks to stronger labor market data and expectations that a debt deal will be secured to avert a US government default. The greenback has extended those gains after a small pullback on Friday.

While there was no deal this weekend, fresh remarks by Minneapolis Fed president, Neel Kashkari, on Monday reminded investors that the Fed could still hike interest rates further at their next meeting, despite the consistent falls in CPI and stress in the banking sector. Fed’s James Bullard added: “I'm thinking two more rate hikes this year.”

However, Bullard is a non-voter FOMC official, so what he thinks doesn’t really matter. But what does matter is the views of the Chairman himself: “While financial stability tools help to calm conditions in the banking sector, developments there, on the other hand, are contributing to tighter credit conditions and are likely to weigh on economic growth, hiring and inflation,” Jerome Powell said at a conference in Washington on Friday. “As a result, our policy rate may not need to rise as much as it would have otherwise to achieve our goals.”

After two weeks of gains, I am now expecting renewed weakness to creep back into the dollar. But we have to see that reversal stick first.

Inflation has peaked in the US, yet policymakers continue to err on the side of caution. In the eyes of the Fed, the US economy has not cooled sufficiently enough to warrant a pivot just yet, although that hasn’t stopped the market on betting over a couple of rate cuts before the end of 2023. Those bets were trimmed somewhat following some hawkish comments by several Fed officials and the release of lower-than-expected jobless claims data last week. All eyes will be on the Fed’s favorite measure of inflation—Core PCE Price index—on Friday.

One of the reasons why I expect the dollar index to weaken again is because of the fact that the optimism surrounding the US debt deal has not filtered through the more risk-sensitive foreign currencies yet. If you look at the rallying US equity markets, investors are evidently optimistic about the US debt ceiling negotiations and not too worried about the slowdown in China. Yet, the same optimism is not evidenced in commodity dollars or emerging market currencies. Meanwhile, US interest rates are already at or near a peak and inflation is on a downward trajectory. There is a possibly that the economy is going to weaken more sharply than expected in the months ahead, allowing the Fed to pivot by as early as September.

The caveat here is that US equity investors might be too optimistic about a debt deal, in which case we may see Wall Street slump on raised default fears.

Pound: All Eyes On UK CPI

Without a doubt, Wednesday’s CPI in the UK will be the most important data for the pound. Inflation is seen falling relatively rapidly from here on, after remaining stubbornly high above 10% for several months. This is because the past big rises in CPI will start falling out of the year-over-year comparison. In March, CPI eased only modestly to remain above the 10% mark for the seventh consecutive time, disappointing expectations.

This time, though, annual CPI is seen falling to 8.2%, which would be the first time in 8 months it will have gone below the 10% mark.

How the pound will react to that kind of a figure is up for debate. I think that a downward surprise might, paradoxically, be good news for the pound, although the immediate reaction might be a straightforward one. Normally, higher-than-expected inflation data means more rate hikes, thus giving the currency more reason to rise. However, when inflation is too high, the negative impact of each interest rate hike on the economy tends to outweigh the benefits the currency may receive from a higher yield. In an environment of high inflation and high-interest rates, the risk that the economy could tip into a deeper recession with each incremental rate hike is higher. So, a weaker CPI print would alleviate those concerns.

The markets are pricing in about 20 basis points of BoE tightening for June. If CPI comes in around expectations or lower, this could convince the BoE to pause tightening in June. However, if CPI turns out to be stronger again, then this could lift the odds of a final 25 bp hike and in doing so, give the cable a potentially short-lived bounce.

Remember, it is not just about whether the BoE would further tighten its belt in June or not, but also how long will it be before it starts loosening it. With CPI so far ahead of the Bank of England's 2% target, relative to US inflation, it is simply too high for the MPC to relax just yet. So, a move back above 1.25 still looks favorable.

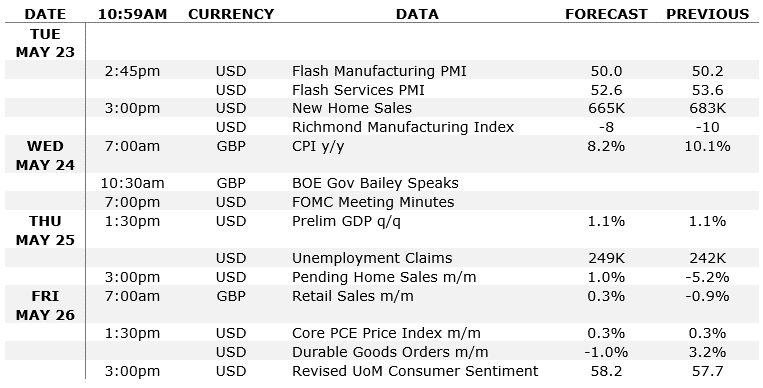

Economic Data That Could Impact GBP/USD This Week

It is not just the UK CPI that could impact the GBP/USD. Here’s the full economic calendar relevant to the cable this week.

As well as UK CPI, we have UK retail sales and the Fed’s favorite inflation measure on Friday among this week’s other key highlights.

GBP/USD Technical Analysis

At the time of writing, the GBP/USD was continuing to print bearish price action after failing to hold above the key of 1.2450 on Monday. The short-term price structure wouldn’t appease the bulls looking to buy the dip. Until a confirmed reversal signal is formed, ideally backed by some supportive fundamental news, the bulls will need to be wary of a deeper pullback, even if the longer-term trend is still arguably bullish.

What the bulls need to see here is a move back above 1.2450 to start invalidating the short-term bearish bias that has become prevalent in recent trade. If this condition is met, then I would favor looking for fresh bullish setups—unless we get a better-looking setup at lower levels.

For now, the bears are happy to see continued breakdown of technical levels. While the cable holds below 1.2450, I wouldn’t rule out a deeper dive into the low 1.20s again.

Let’s see what the rest of this week brings, as a lot could change with regard to the debt ceiling situation, while upcoming inflation data from both the UK and the US could also impact the direction of the cable.

Source: TradingView.com

To learn more about Fawad Razaqzada visit TradingCandles.com.