Covered call writing exit strategies can involve trade adjustments over one or more expiration cycles, states Alan Ellman of The Blue Collar Investor.

This article will analyze a series of trades shared with me by Ken, where the share price of IBKR declined after entering the trade and a decision to retain the shares for the next cycle, and the (now) out-of-the-money call was rolled out to a later date expiration.

Ken's IBKR Trades

- 11/2/2022: Buy 200 x IBKR at $80.30

- 11/2/2022: STO 2 x 11/18/2022 $80.00 calls at $2.52

- 11/11/2022: BTC 2 x 11/18/2022 $80.00 calls at $0.25 as the share price declined to $75.06

- 11/21/2022: STO 2 x 12/16/2022 $80.00 calls at $0.80 (rolled out but not at the same date for each step)

Questions to Analyze

- How do we enter these trades into the Trade Management Calculator (TMC) or another spreadsheet?

- How many spreadsheets are required?

- How are these trades archived in our spreadsheets?

- Could these trades have been better managed to create opportunities to mitigate current losses? Analyzing our trades makes us all better investors and the learning process never ends.

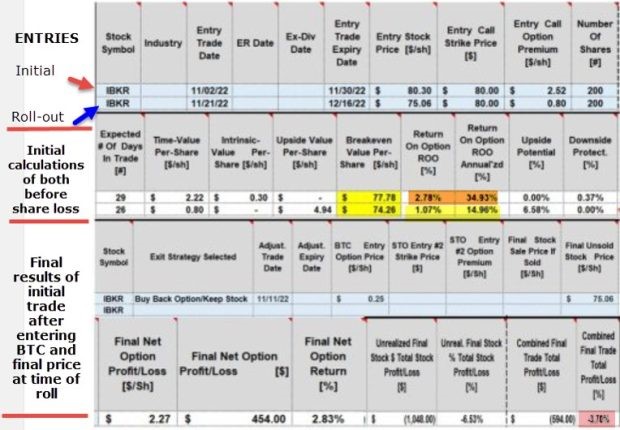

IBKR: Initial Entries and Final Calculations Plus Rolling Initial Calculations

The screenshot shows both trades in the same image for easier viewing but, typically, we would use two separate spreadsheets based on the two expiration dates. As an example:

- TMC_11-18-2022

- TMC_12-16-2022

Note the following:

Top Section:

- Initial covered call trade entries

- Initial rolling-out trade entries

Middle Section:

- Initial calculations of both trades, before entering share loss at the time of the “roll”

- Brown cells: Initial covered call trade calculations (2.78%, 34.93% annualized)

- Yellow cells: Initial rolling-out calculations at the time of the roll (this is where the second trade stands now)

Bottom Section:

- Final results of initial covered call trade, after closing the first short call and prior to rolling

- The exit strategy is named (buying back call and keeping the stock)

- The cost to buy back the call is entered ($0.25)

- The final price prior to rolling is entered ($75.06)

- The final loss is calculated in the pink cell for the initial trade (3.7%) and we move on to the (now) rolled-out trade

Evaluating the Trade Decisions: Our Thought Processes

- On 11/11, why was I bullish on IBKR that motivated retaining the shares? If we can think of no reason, the BTC and retain shares decision should be re-evaluated

- Prior to the last two weeks, after closing a short call (usually the result of a breach of the 20% guidelines), should waiting to “hit a double” opportunity have been considered (yes), rather than rolling out?

- If the share price did not recover, should rolling down in the same expiration cycle be considered in the last two weeks of the contract or, perhaps, selling the stock (yes)?

- Were the 20%/10% guidelines breached (yes, but BTC was at 10%, and should have been closed earlier at $0.50...fortunately, did not miss out on any exit strategy opportunities)?

- If a decision to roll out to the 12/16/2022 expiration was made after closing the short call, should that have occurred on 11/11/2-22, rather than 11/21/2022 to capture ten additional days of time-value premium (yes)

Discussion

By forcing ourselves to associate a rationale for every trade or trade adjustment decision, we will allow ourselves to make non-emotional trades based on sound fundamental, technical, and common-sense principles.

Learn more about Alan Ellman on the Blue Collar Investor Website.