I emphatically denounced last week's rally with a seeming break above the key 4,200 resistance level, states Steve Reitmeister of Reitmeister Total Return.

The short version is to stress that this rally is totally hollow and only being led by a handful of mega caps. No breadth...and thus no credibility. This market is at a critical juncture. Bulls are desperately seeking a clear green light to race ahead while bears remind everyone of the red flags that could send stocks zooming lower. Let's review the potential four potential catalysts in June and the likely outcome for stocks.

Market Commentary

The economic calendar is chock full of potential catalysts going into mid-June. At this stage bulls need the bears to abandon hope and join their cause. That will only happen if there is undeniable evidence that a recession is not forming and the economy is only getting stronger. On the other side of the ledger, the bears need to stop talking about the “potential of recession” and show it coming true in reality. That would awaken bearish spirits from their several-month hibernation leading to stocks getting mauled in short order.

Here are the four key dates that could serve as the catalyst for the next big stock move:

Thursday, June first = ISM Manufacturing: There have been MANY weak readings for ISM Manufacturing without truly signaling a recession was at hand. However, this is still one of the key monthly reports to monitor the health of the economy.

Very unlikely to convince investors all by itself. But this report could set a tone where investors seek confirmation from the other monthly reports that could tip the scales strongly in one direction or another. Note that many of the regional manufacturing reports of the past month have been weak and thus foreshadow similar poor readings for this national report.

Friday, June second = Government Employment Situation: Job adds are expected to keep ebbing lower down to 180,000 this month. Note that population growth demands 150,000 job adds per month just to maintain the existing unemployment level. So, any movement under that mark could have investors predicting a spike in the unemployment rate.

Also, many eyes will be on the Wage component as that sticky inflation has been clearly bothersome to the Fed. That is currently expected to come in at +4.4% year over year. (It doesn’t take a math wizard to appreciate how much higher that is than the 2% Fed inflation target and what I am about to say in the next section).

Monday, June fifth = ISM Services: This report was in positive territory at 53.4 last month. But if that cracks under 50 into contraction territory it definitely would increase the odds of a recession ahead. Not helping matters was the most recent Retail Sales report which showed a -3.3% year-over-year decline after removing the artificial benefit of inflation.

Wednesday, June 14 = Fed Meeting: Most investors are expecting that they will pause raising rates. And that is quite likely. However, that is quite different than pivoting to lower rates which they still claim is a 2024 event. So, the Powell press conference that follows the rate hike decision will be closely watched for timing clues for any future pivot.

Please remember that the Fed coordinates a lot of messaging in the speeches of Fed officials as part of their mission to have clear communication with investors. And the CLEAR message this past month has been “more work to do” to bring down inflation.

As in higher rates for longer and no reduction in rates this year. As in the same thing they have said all year long...and no doubt will say again on June 14th...no doubt disappointing bulls who continue to NOT get the message straight.

How Do I Think It’s All Going to Turn Out?

Simply stated, if the Fed is betting on a recession in the future because of their efforts to tamp down the flames of inflation...then you should bet on that too!

With that in mind, now let me share with you the most interesting thing I read this weekend. That being comments from famed Swiss money manager Felix Zulauf on an effective early recession warning and what that tells him about our current recession watch:

“We only know by hindsight when the recession started, but there is an indicator you can watch that gives you some indication when the start of the recession is here, without knowing for sure. And that is when the inverted yield curve begins to flatten.

“And actually, in the last few days or two weeks or so, we saw some flattening of that yield curve, and this could be an indication that we are very close to the beginning of a recession. I do believe that such a recession will be short, not long. It could be deep because I think the Fed and other central banks are overtightening. They drive forward by looking into the rearview mirror because inflation is a lagging indicator, and monetary policy is a leading indicator.

“So, I think they overtighten, and it could be a sharp or deeper recession, but much shorter because once it’s here and once it’s recognized, the Fed and other central banks will come in and turn around and go from tightening to easing relatively quickly.

“I think that in the third quarter, we will see that the Fed will give up its QT policy, the quantitative tightening, and if the market declines the way I expect, and it could lead to lower lows, I still have a target that I told my subscribers in late ‘21, about 30% down, which is the low 3,000 in the S&P and maybe 9,000 in the Nasdaq or something like that. That means lower lows below the October lows, sometime in the second half towards later this year.”

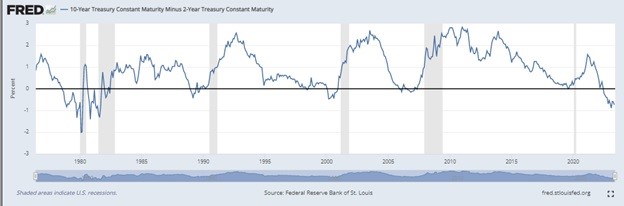

And here is a correlated chart showing the two-year vs. ten-year rate inversion over time and its relation to recessions (gray bars):

Indeed, you can see that the recessionary periods did not happen at the deepest moments for the yield curve inversion. Instead, it took place after it flattens out and often starts to improve.

Now take that into consideration as you look at the far right of the chart where the most recent inversion has started to flatten out. And correlate that with the 10% expected drop in corporate profits in Q2. And now correlate that to Fed expectations of a recession forming by the end of the year before they start lowering rates.

Bulls have enjoyed a righteous rally since October as a recession did not emerge. This made it appropriate for stocks to bounce back to current levels. However, to proceed higher from here they need to make sure that fears of recession are dead and buried. And as shared above, there is still good reason for caution.

Thus, I will not be joining the bullish rally at this time. Instead, I am going to continue my vigilant watch for the next big catalyst that will conclude the bull/bear debate once and for all. Yet if you asked me now to predict what will happen down the road...I would most certainly bet on the bearish outcome.

Closing Comments

For as much as it is possible that June holds the key catalysts to settle the bull/bear score once and for all. Unfortunately, it is also possible that not enough convincing evidence emerges to keep stock in the same range we have seen all year long.

We cannot control market events...only our reaction to them. Gladly we are ready for whatever those events are. Just hope it comes together sooner rather than later as this limbo is appealing to NO ONE.