Among yesterday’s political headlines, the Republican candidate race, Ukraine’s offensive and smokey skies, some mainstream media outlets also reported that the US stock market was officially bullish again, states Ian Murphy of MurphyTrading.com.

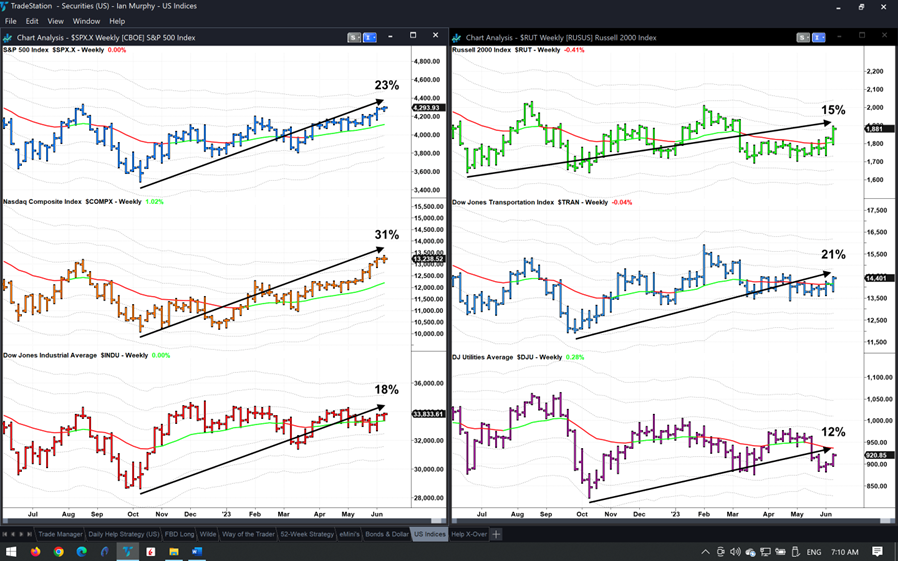

They are a few weeks behind the curve but better late than never. Presumably, they were referring to the 20% gain on the S&P 500 (SPX) since the October lows, but other indices have outperformed it, especially the NASDAQ which has benefited from the AI bubble. Not surprisingly, as funds rotate out of defensive stocks in search of growth the Dow Jones Utilities Index has underperformed the rest of the market.

As you know, technical levels for defining bullish and bearish trends are more accurate and the S&P 500 closed above its 1ATR line and entered bullish territory on the week ending April 28. Over the coming months, we need to see the indices remain above this level if a trend change has genuinely occurred.

In terms of trading this ‘new bull market’ (if it really is one), let’s not forget the 52-Week Strategy flagged entries last December and January.

In addition, if the indicator closes positive this afternoon, we will get another entry signal which I have provisionally marked with a dashed green line. The soft trailing stop has moved up to $47.47 with this week’s positive price bar dragging the ATR channels higher.

Learn more about Ian Murphy at MurphyTrading.com.