It’s boom time. A massive wave of money is plowing into equities, states Lucas Downey of Mapsignals.com.

There’s a mega rotation into small-cap stocks. Data is beautiful. It uncovers the biggest trends. More importantly, it spotlights NEW emerging trends, just as they begin. As an investor, that’s a golden opportunity. Staying ahead of the crowd is the edge you need to succeed in trading.

Today, we’ll unpack the money flows reshaping the market. Believe it or not, we’re witnessing the second largest risk-on tape all year. You just need a map to see it. Finally, I’ll zero in on the best sector for near-term upside. Get your rally hats on folks!

Mega Rotation into Small-Cap Stocks

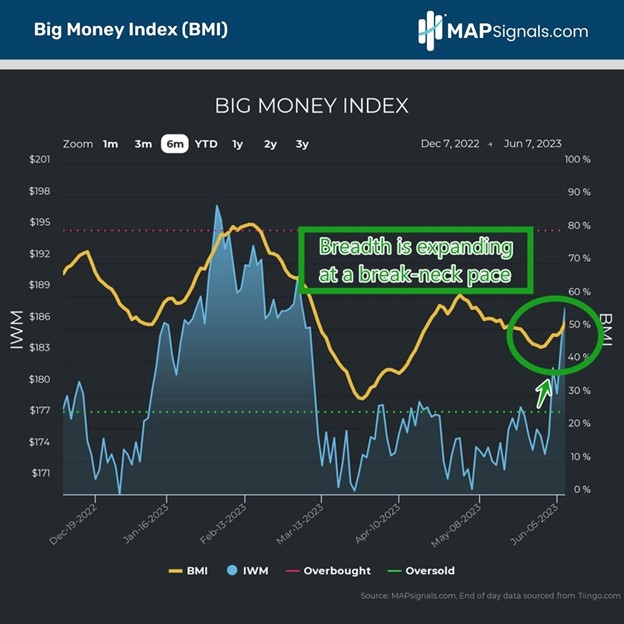

If you sensed that I’m constructive on stocks, it’s for a simple reason. Equities are getting bought in a monster way. Our Big Money Index (BMI) is the market X-ray. Beginning in June, it started a new uptrend. I’ve overlaid the BMI with the Russell 2000 ETF (IWM):

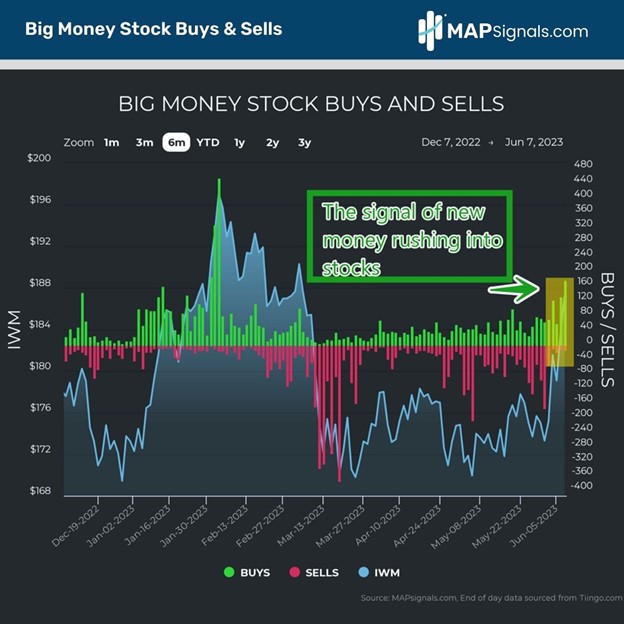

I’ve circled the quickly changing data that began last Thursday. Out of nowhere, a hungry appetite for stocks appeared. This suggested to me that a bullish trend change was underway:

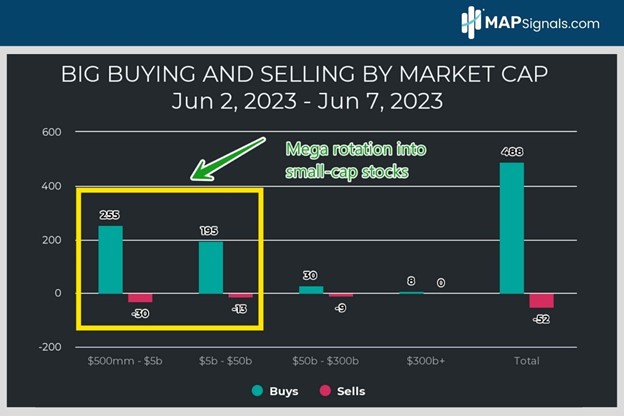

On Thursday's selling, we slowed just enough to set the BMI in motion higher. But there’s more. Diving deeper, the real picture illuminates. Our proprietary algos spotted something we haven’t seen in months: a mega rotation into small-cap stocks. Get this. There were 488 stocks bought between Friday and Wednesday of this week. 92% of those inflows were in market caps below $50B:

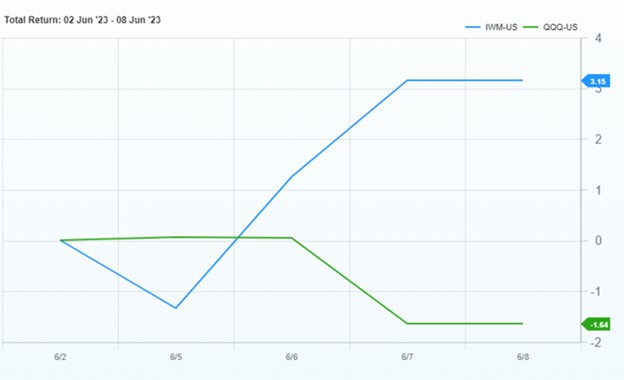

Ladies in gentlemen, that’s an incredible wave of money rushing into an unloved category. That spark of life ignited a beautiful rotation out of mega-cap growth and into small caps. The past four trading days saw the Russell 2000 ETF outperform the NASDAQ 100 ETF (QQQ) by an eye-popping 4.79%!

Source: FactSet

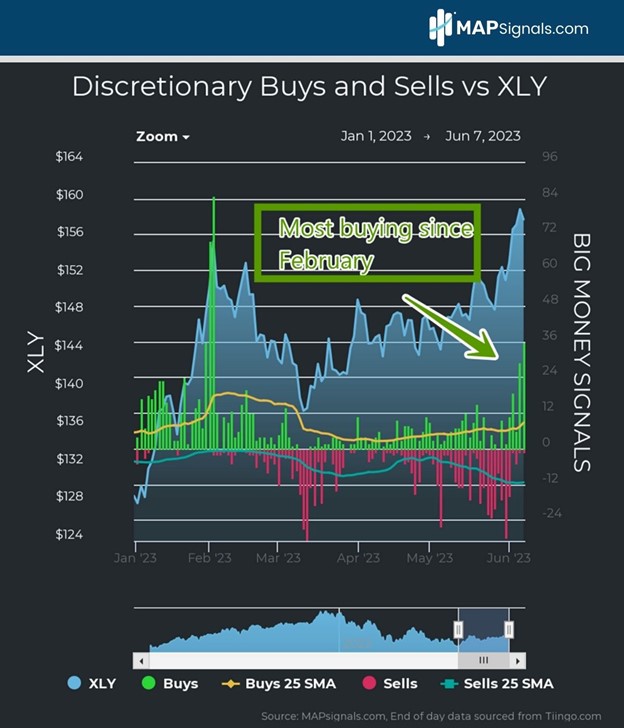

This move came right on the heels of last week’s message: Go long Materials Stocks. Since that pre-market post, the Materials Sector ETF (XLB) is up 5.17%. But what about now? Which area should investors focus on in the coming weeks? Some of the best small-cap fishing is in the Discretionary space. Not only has it been the 2nd best ranking group all year in data, but it’s also one of the main beneficiaries of the mega rotation into small-cap stocks. The last 2 days saw dozens of high-quality names bought:

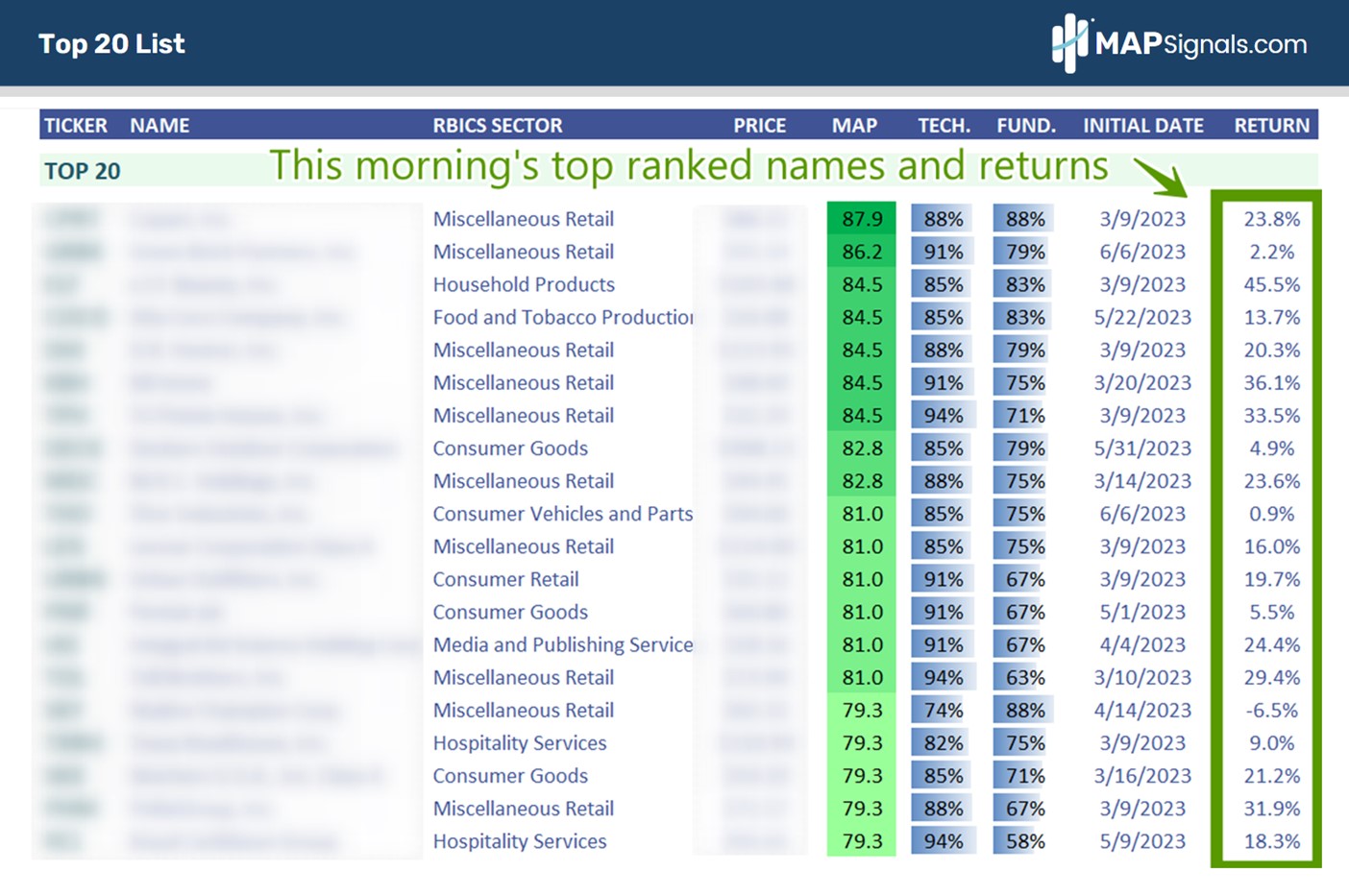

This now brings me to the all-important message. Certain companies in the discretionary space are in monster bullish uptrends. Each morning our portal updates with the top 20 ranked stocks by major sector groups. Below is a snapshot of this morning’s Retail/Consumer list. This is the A-team of stocks. I’ve blurred out the tickers and bracketed the performance of these names. Many are in the middle of healthy uptrends, with double-digit returns:

My tune hasn’t changed this year: Keep betting on high-quality stocks. The latest surge in small-cap stocks only reinforces this theme. There is a ton of opportunity out there – Follow the Big Money, baby! Let’s wrap up.

Here’s the Bottom Line: Breadth is expanding in a big way. We’re noting some of the largest inflows all year. The mega rotation into small-cap stocks is set in motion. A great way to participate in further upside is via discretionary stocks. But be choosy. Focus on the best stocks under accumulation.

To learn more about Lucas Downey, visit Mapsignals.com.