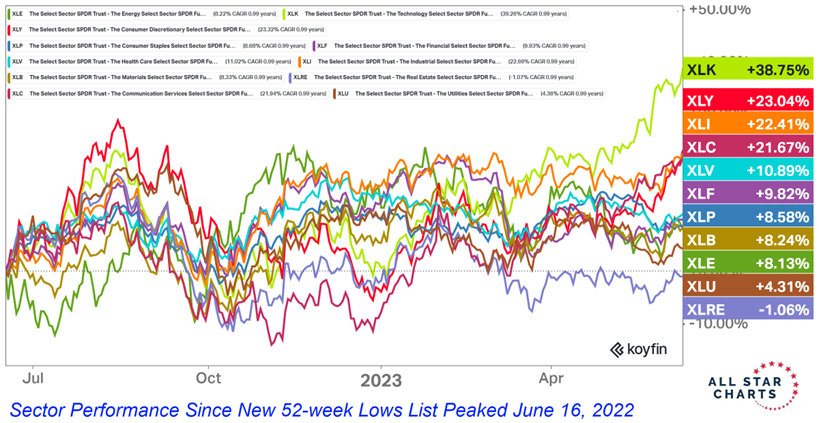

How's the Bull Market treating you so far? Can you believe it's been a year already since the new 52-week lows list peaked, asks JC Parets of AllStarCharts.com.

Remember, the first thing stocks need to do before they can start to go up in price is to stop going down! That happened 1-year ago. Since then, Technology, Communications, Consumer Discretionary, and Industrials are all up over 20%. Tech is up almost 40%. Meanwhile, Healthcare and Financials are each up 10% during this period. And then some of the more defensive sectors, like Staples and Utilities, are up, but very much underperforming the more offensive sectors.

This is all perfectly normal behavior in bull markets, so we're not surprised at all. No one should be. Here's a chart of each sector's performance since the start of this bull market—exactly one year ago!

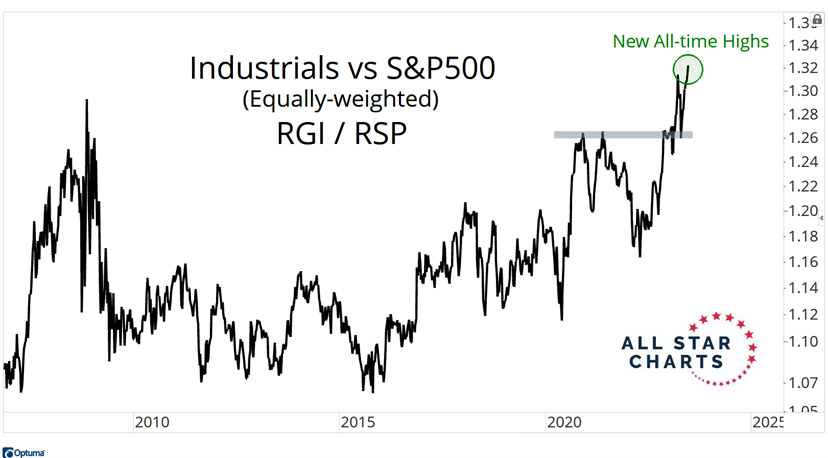

The stocks that performed the worst in the back half of last year are the ones that have performed the best this year. We call that sector rotation. So the next step for this bull market would be to rotate once again into those initial leaders off the lows last summer. Industrials are front and center in that conversation. What's interesting is that on an equally-weighted basis, Industrials keep making new all-time highs relative to the S&P 500 (SPX):

I believe the rotation has already started. You're seeing it in Industrials. And you're seeing it in Small-caps. The trades we put on last month, in both Caterpillar (CAT) and in Russell 2000 (IWM) have hit our initial targets and we now have a free ride with no risk until those options expire towards the end of the year.

To learn more about JC Parets, please visit AllStarCharts.com.