US equity markets are closed today for Juneteenth National Independence Day, but we could use the opportunity to create a watchlist for some short-term swing trades, states Ian Murphy of MurphyTrading.com.

Seeing as our trend-following positions are climbing slowly and profitably upward, let's see what we can do. When creating a watchlist for our screener it helps if we have something ‘extra’ in the list apart from the usual liquidity criteria. Stocks with a high short float can provide that extra kick and I like to scan for that condition regularly. A ‘high short float’ means a large percentage of the issued stock has been borrowed and shorted by traders.

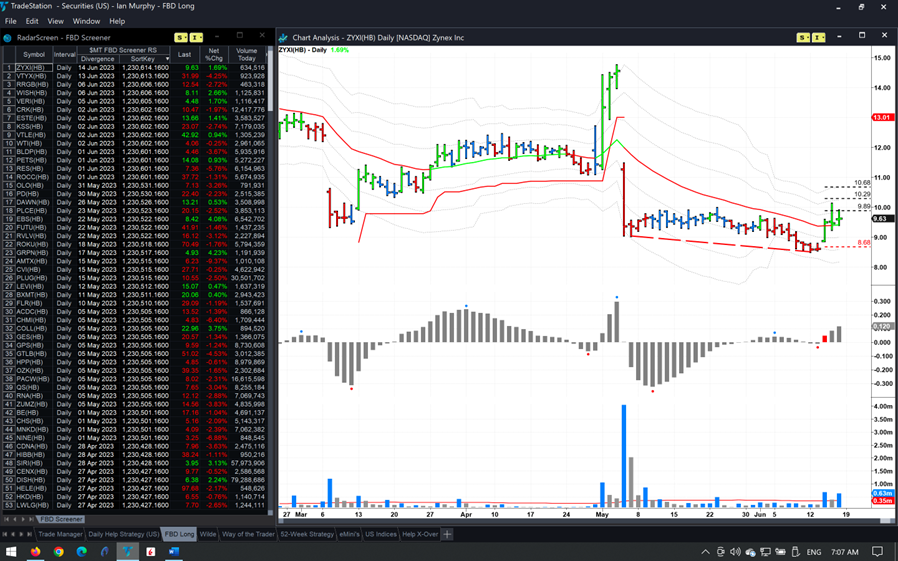

This morning I scanned all US stocks for a short float of>10%, followed by the usual liquidity levels of price >$3 and average volume >300k per day. 404 stocks came out the other end and they’ve been dropped into the screener for FBD (false breakout with a divergence) signals.

For example, Zynex Inc. (ZYXI) was triggered last Wednesday and has reached the first target already (right of the chart). With a short float of 23%, this could pop even higher in the week ahead. Notice the rising volume as the stock is catching some interest in the market. Earnings are due around July 27.

Learn more about Ian Murphy at MurphyTrading.com.