Tech bulls were pushed back on Friday as the Nasdaq 100 faltered despite reaching an intraday high of 15,285. The benchmark ended at 15,084, a loss of 0.7%, states Jon Markman, editor of Strategic Advantage.

Even with the decline, the Nasdaq 100 gained 3.8% on the week, the best five-day advance since March, and the eight consecutive weekly advance. Tech shares have been bolstered by constant inflows from professional money managers. They came into 2023 with a strong bearish bias and remained under-invested through most of the early part of the year.

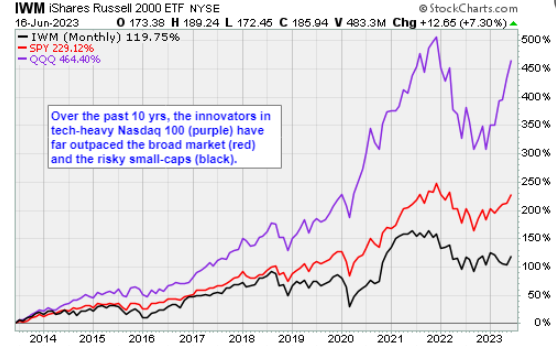

As the technology-heavy Nasdaq 100 surged in May, pros were lured in, chasing performance. The rally thus far has been entirely predictable, with inflows concentrated on artificial intelligence leaders. Nvidia (NVDA), Microsoft (MSFT), and Oracle Corp. (ORCL) all sailed last week to record highs on stronger volume.

Bears have one hope to reverse or derail the Nasdaq 100, and it is a long shot. They need pros to start culling the ranks of AI me-too businesses. This activity would curtail the mania that is currently lifting the shares of so many AI-adjacent firms.

I wrote last week that Advanced Micro Devices (AMD) shares have been in steady decline since company executives released a competitor to the Nvidia H100, the current industry darling. AMD shares sunk on Friday by 3.4%. The bears need much more of this.

The benchmark did kiss critical overhead resistance at 15,265 on Friday before retreating into the close. This is technically a one-day reversal. There is important support at 14,775, then 14,453, the rising 20-day moving average. Be ready to buy any decline to the lower level.

The NDX Loop: No new recommendations at this time in our proprietary market timing system. The Loop netted members 16.5% in its last three-week effort. The next play coming soon.

Behind the Headlines: The Nasdaq Composite slid 0.7% to 13,689.6, while the Dow closed 0.3% lower at 34,299.1. Communication services led the decliners among sectors, followed by technology. Utilities, materials, and consumer staples posted gains. Breadth favored decliners five-three. There were 108 new lows vs 642 new highs.