If there is more demand for stocks than a supply of them, their prices will grind higher, asks JC Parets of AllStarCharts.com.

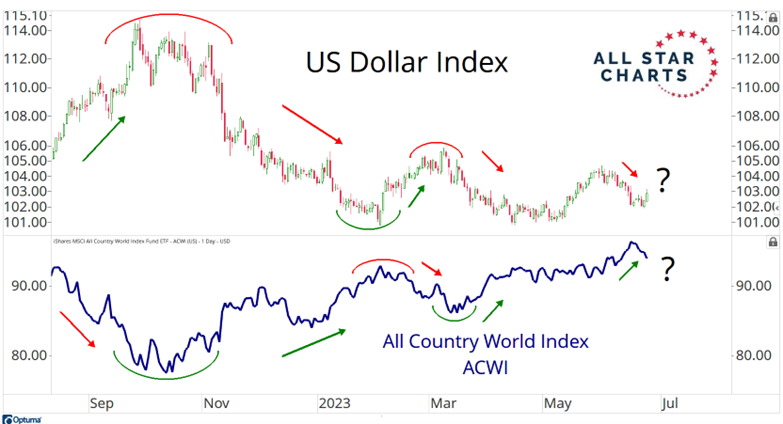

That's how markets work. If it's like 2021, where there was more supply of stocks than there was demand for them, prices were falling and continued to fall into 2022. A stronger Dollar put a lot of pressure on stocks during that period. But since Q4 last year, the Dollar has been weak, and stocks have seen a steady and consistent bid all over the world:

We've been buying stocks so aggressively since last year, despite all the gloom and doom, because of that weaker Dollar. So moving forward, what are we looking for to increase stock prices? Perhaps a weaker Dollar will continue to be that catalyst. The chart above shows this correlation well. Another asset that's benefited from a weaker Dollar is Bitcoin. Over the weekend, we discussed the very real risk of not owning enough BTC. This is what Bitcoin looks like hitting new 52-week highs:

If the Dollar can catch a bid this summer and into the early Fall, I think stocks are likely to struggle in that environment. There's little evidence, however, of a sustainable uptrend in Dollars at this point. The majority of the data continues to point towards a lower US Dollar. I think this could be the catalyst to keep driving stock prices higher. Bitcoin too.

So we'll be watching for any changes in Dollar trends as a reason to reevaluate any bullish thesis in these risky assets. And finally, what about commodities? Will a weaker US Dollar finally get commodities going again? Is that why these Agriculture-related Futures have been catching a bid lately? Here's what the latest C.O.T. Heatmap looks like:

Click the table to enlarge it.

COT Heatmap Highlights

- Commercial hedgers remain near three-year extremes after hitting a record-long position in palladium.

- Commercials unwind their net-long position in lean hogs, dropping almost 24,000 contracts over the trailing four weeks.

- And commercials hold their largest short position for the British pound in three years.

To learn more about JC Parets, please visit AllStarCharts.com.