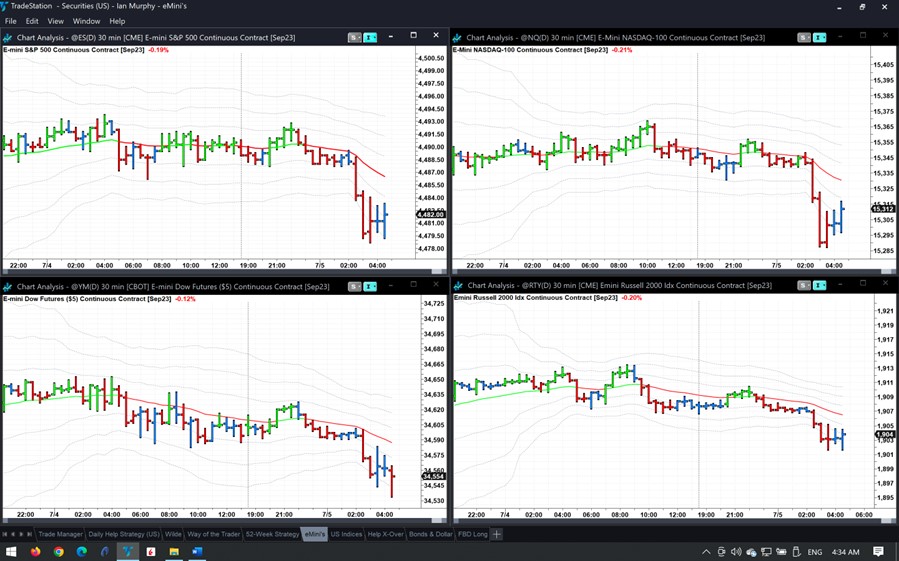

There is a severe outbreak of ‘risk off’ in equity markets this morning due to lingering concerns about China’s stalled economic recovery, states Ian Murphy of MurphyTrading.com.

On average, European indices are currently in the red to the tune of 0.5% following deeper falls in Asian markets overnight, while futures for US equities are also heading south. Considering the stellar run-up in stocks over the past few months a pullback at this stage is completely normal and is to be expected as some profit-taking occurs coming into the summer.

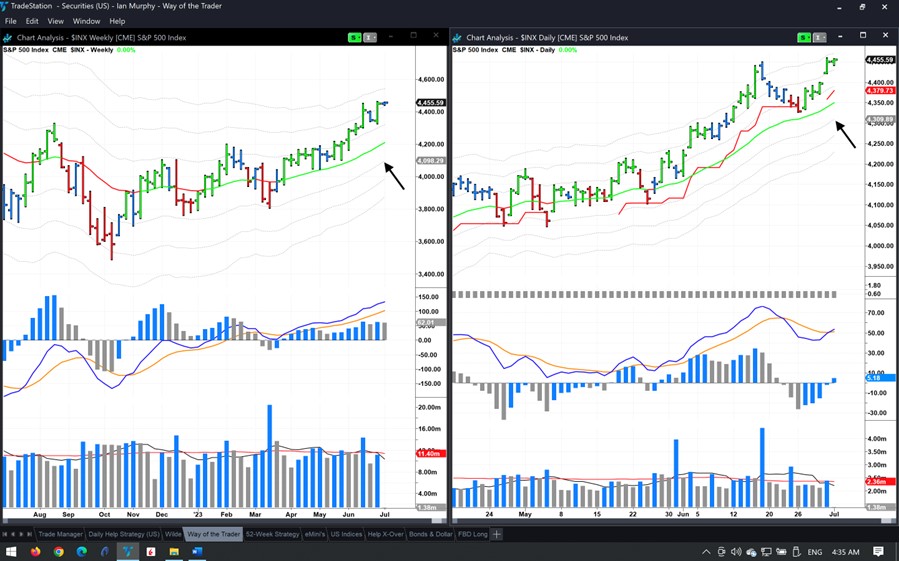

Rather than speculating or panicking, we should now focus on technical levels to confirm if this is a normal pressure-releasing pullback or a genuine trend change from bullish to bearish.

As always, the -1ATR line on a daily chart (right above) of the S&P 500 (SPX) should hold as support first, if that fails then the line in the sand for bulls is the -1ATR on a weekly chart (left). If the S&P 500 closes below that for two weeks, the bull market has officially left the building.

Learn more about Ian Murphy at MurphyTrading.com.