US index futures fell along with European markets in the first half of Thursday’s session, ahead of the publication of key US data, states Fawad Razaqzada of Trading Candles.

Concerns over rising interest rates have dampened risk appetite, hurting the Nasdaq outlook in the short-term outlook.

What Is Driving Markets?

If you want to know what is driving asset prices, look no further than the bond markets. Investor realization that more interest rate hikes are potentially on the way caused government bond yields to rise further, something that hurt zero-yielding gold and held back global equities yesterday.

Interestingly, XAUUSD has bounced back today, but it remains vulnerable in the face of rising yields.

It is also interesting to note that the Nasdaq and other US indices have fallen a lot less than their European and Chinese counterparts.

But that could change if yields continue to press higher.

Source: TradingView.com

Hawkish Fed Will Be More Data Dependant Moving Forward

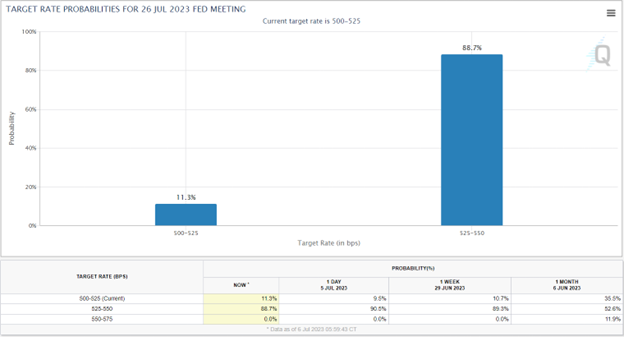

The latest upsurge in yields was triggered by June’s FOMC meeting minutes, which offered little reason to doubt the Fed will go ahead with a hike this month. The market is almost 90% this will be the case. I doubt this pricing will fall significantly with any small misses in upcoming US data. It will take a very bad ISM PMI and a bigger-than-expected rise in the unemployment rate to push the pricing of a July hike below 50% this week.

Key US Data Eyed

The most important data in today’s US economic calendar is undoubtedly the ISM services PMI for June. Last month, the PMI fell to 50.3 and surprised on the downside. This time, analysts are expecting it to bounce back to 51.2. This means the scope for disappointment is there, and if we see a drop into contractionary territory then recession alarm bells will be ringing loudly again. That’s because the ISM manufacturing PMI has already been sub-50.0 in the past eight months.

Ahead of the PMI data, we will also have some labor market data to consider, which include the weekly jobs report and more to the point, the ADP payrolls for June.

The JOLTS job opening figures for May will be published later at the time as the ISM PMI.

Nasdaq Technical Analysis

From a technical point of view, the Nasdaq has hit resistance around the 15200-15250 area, where it had previously struggled in the past—see the chart.

Source: TradingView.com

Naturally, you would expect to see some reaction here, as we have seen. Unsure whether to sell or hold, the actions of traders on Wednesday helped the index to create a doji candle here. This shows indecisiveness and an early signal that the market may have formed at least a temporary top.

What is lacking so far is confirmation.

A beak and hold below Wednesday’s range is what the bears will be looking for today. If seen, that would also encourage the bulls to take profit on what has been a very good year so far in the tech sector, especially considering everything that’s going on from a macro point of view. It would tip the Nasdaq outlook in the favor of the bears, at least temporarily anyway.

While the abovementioned pattern does look bearish, it has not been confirmed. So, remain open-minded to the possibility that the 15200 resistance level could still break to the upside. With that in mind, a potential close above Wednesday’s high would invalidate any bearish signals that have emerged so far this week.

To learn more about Fawad Razaqzada visit TradingCandles.com.