The sudden spike in US stocks making new 20-day lows was so pronounced in yesterday’s session that I had to double-check the numbers this morning, states Ian Murphy of MurphyTrading.com.

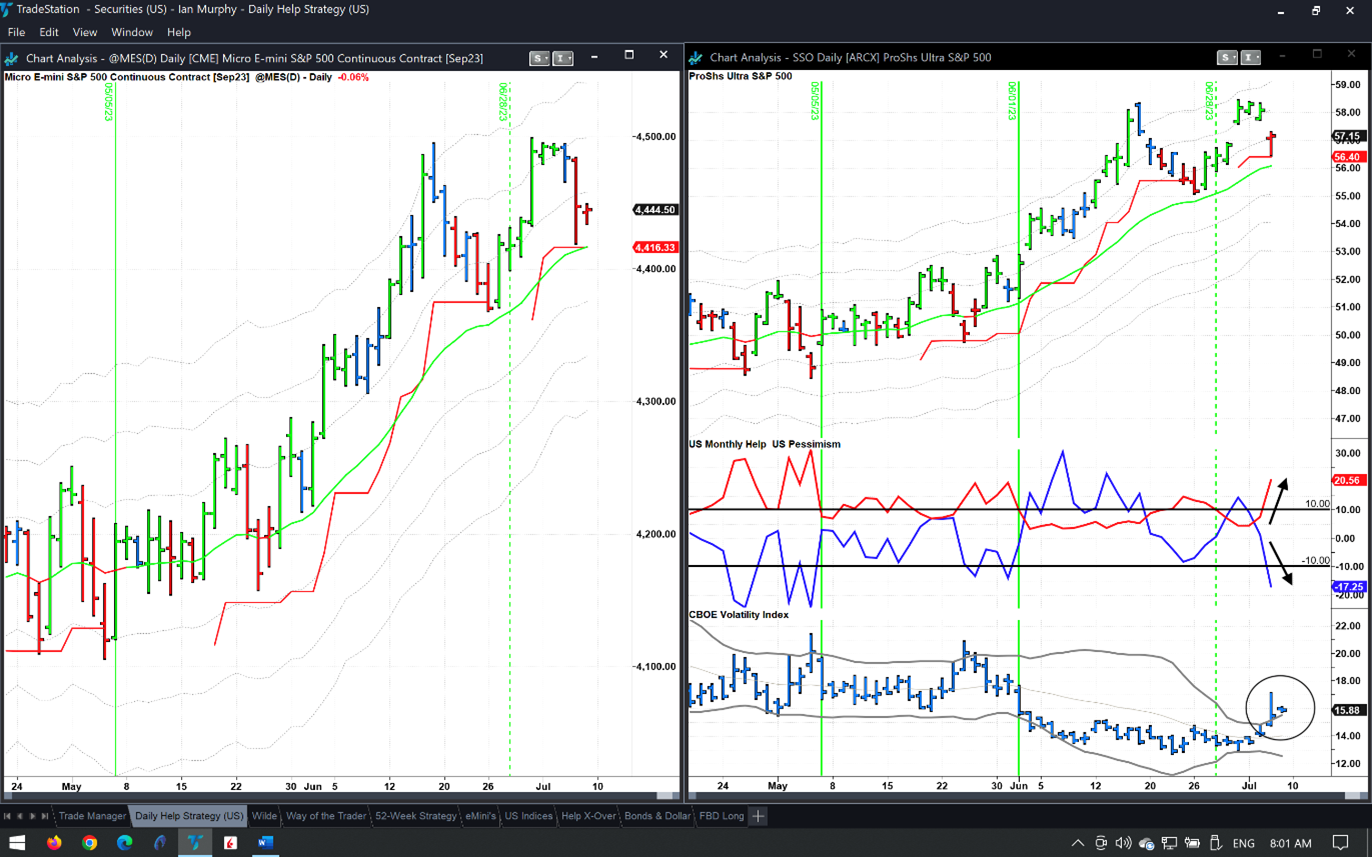

And sure enough, Thursday’s drop was broad-based. Looking at the Composite Indicator we can clearly see that a bearish divergence was building for some time, and it confirmed yesterday with the lower peak on Composite.

This implies the heavily weighted stocks on the S&P 500 (SPX) were making higher highs while the ‘regular stocks’ had already started to decline.

In practical terms, this means a cluster of daily swing trades have been stopped out, but weekly trend followers are still in as the selloff has not been deep enough to hit stops—so far! The Help Strategy has started to line up for another trigger as Pessimism and Help burst out of the channel (arrows) and Cboe SPX Volatility Index (VIX) has blown out of its Bollinger Band restraints (circle).

Finally, in yesterday’s Client Webinar, we looked at Trupanion (TRUP) for a daily swing trade. This stock offers insurance for cats and dogs and has already hit the first target. The entry bar stops, targets, and earnings dates are shown above.

Learn more about Ian Murphy at MurphyTrading.com.