Selling cash-secured puts is a low-risk option-selling strategy where the seller undertakes the contractual obligations to buy shares at the strike price, by the expiration date, states Alan Ellman of The Blue Collar Investor.

In return for undertaking this obligation, an option premium is collected. There are many ways these trades can be crafted, and this article will provide an overview of several of these applications. This is part one of a two-part series that will be concluded in the next blog publication.

Practical Applications of Selling Cash-Secured Puts

–Traditional put-selling

–PCP (wheel) strategy

–Buy a stock at a discount instead of a limited order

–Ultra-low-risk put strategies

- Delta

- Implied volatility

Traditional Put-Selling

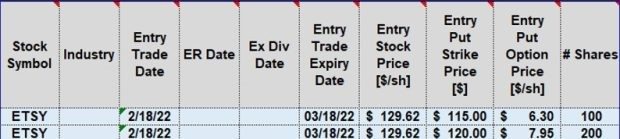

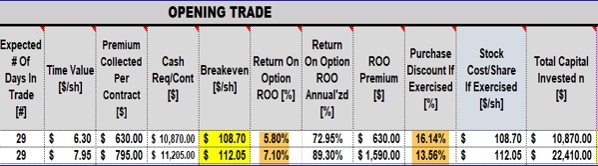

After selecting an elite-performing stock (or ETF), an out-of-the-money cash-secured put is sold, agreeing to buy the shares at the lower strike by the expiration date. Here are the option chain and initial trade entries and calculations using the BCI Trade Management Calculator:

ETSY Put Option-Chain

ETSY: Trade Entries into the Trade Management Calculator

ETSY: Initial Trade Calculations

- Yellow cells: Breakeven price points

- Brown cells: Initial 29-day returns and purchase discount amount, if exercised

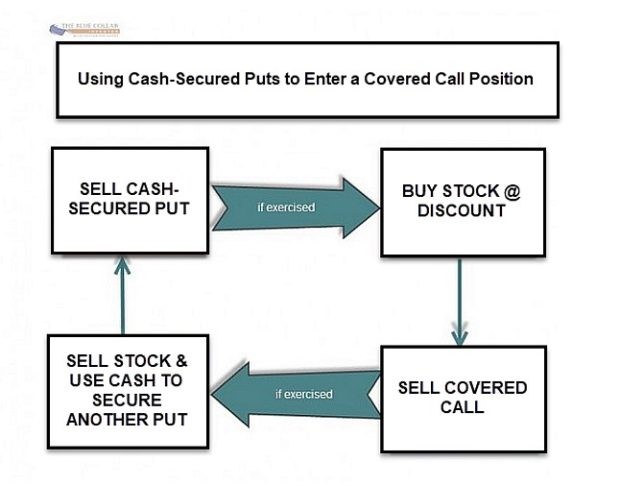

The PCP (Put-Call-Put or “wheel”) Strategy

Strategy protocol

- Sell an OTM cash-secured put

- If no exercise at expiration, use the freed-up cash to then secure another cash-secured put

- If the put is exercised, write a covered call, ITM for a defensive posture, or OTM for a more aggressive position

- If the covered call is not exercised at expiration, write another covered call for the next contract cycle

- If the covered call is exercised, use the cash from the stock sale to then secure another put sale

Graphic representation of PCP

The PCP Strategy

Discussion

There are multiple ways we can implement selling cash-secured puts. This article provided an overview of two such applications. In our next publication, buying a stock at a discount and two ultra-low-risk methodologies will be discussed.

Learn more about Alan Ellman on the Blue Collar Investor Website.